Ampli review

Money.ca / Money.ca

Updated: August 08, 2023

Ampli highlights:

- Cash Rewards

- Passive Earning

- Stacking Loyalty Reward Programs

About Ampli

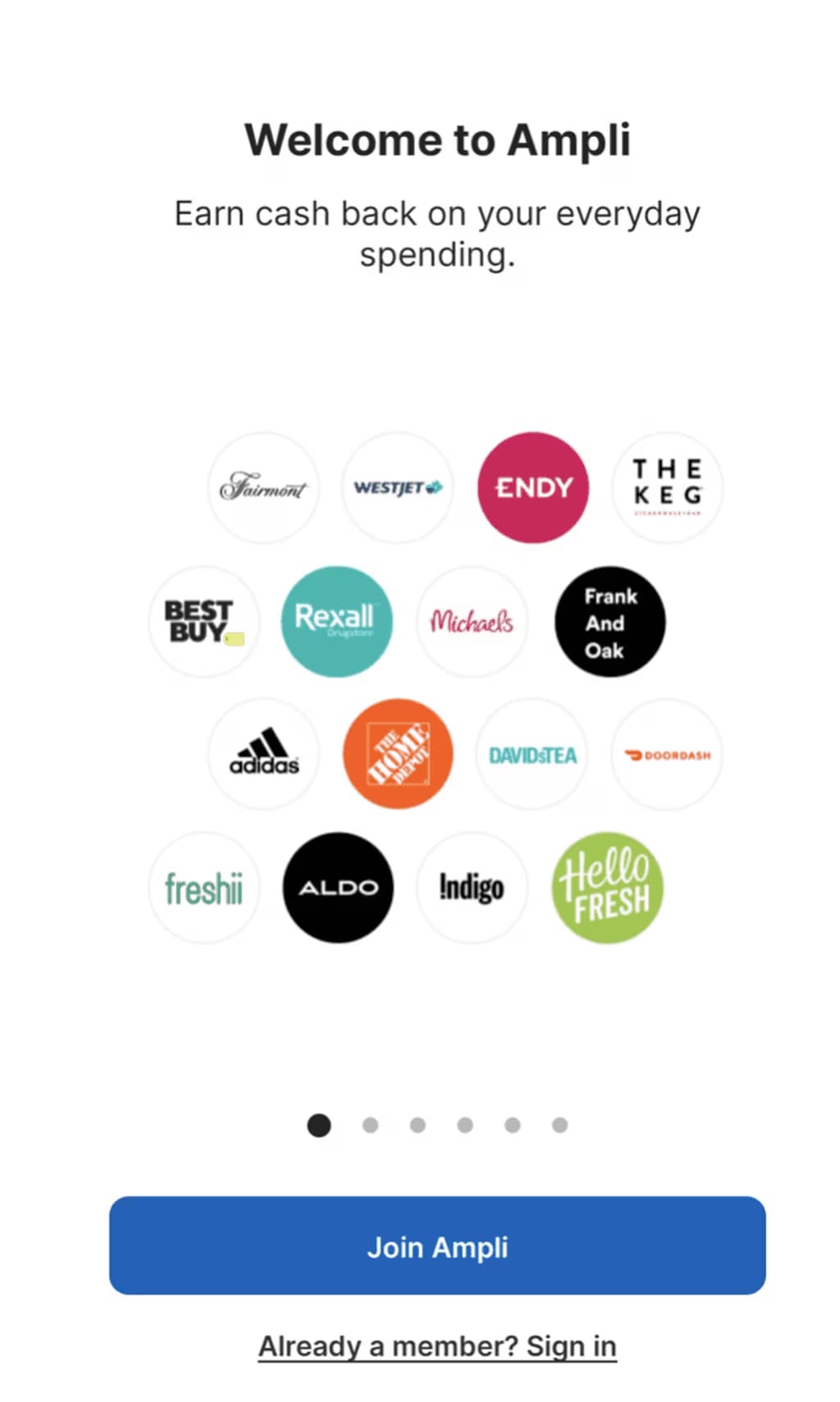

Founded in 2019, Ampli is Canada’s latest loyalty rewards program. It’s a cash back app that gives users money (either a percentage of a purchase or a set amount of cash) when they make purchases at participating retailers. Eligible merchants include WestJet, Home Depot, Freshii, Hudson’s Bay, The Keg, Rexall and more.

There are no fees to use Ampli. You simply download the app (Android and iOS versions are available), link your debit and credit cards and automatically earn money when you make a qualifying purchase. Best of all, users can “double-dip,” meaning they can also still earn rewards and points from other loyalty programs (like reward credit cards) you already participate in. You can cash out with a minimum $15 balance and your money will be sent via Interac e-Transfer to any Canadian bank account.

Key features

- Earn cash, not points: While loyalty points are great, they nonetheless require extra steps — like figuring out what your points are worth and then going through the process of redeeming them for a specific reward. But Ampli gives you cold, hard cash so there’s no complicated or time-consuming redemption process to figure out.

- Double dipping: Users can earn money via Ampli, as well as earn any other eligible rewards from other applicable loyalty programs.

- Automatic: You don’t have to sign up for specific offers or upload receipts—offers are automatically redeemed as long as you shop using a linked card.

- Prizes: You will be automatically entered to win monthly prizes when you complete specific challenges, like spending a minimum amount at a store or referring a friend.

Pros and cons

The benefits of Ampli are many: it’s a free app that gives you automatic cash rewards on everyday spending at participating retailers. The ability to stack rewards from other loyalty programs makes this app stand out above the competition. On the downside, you must shop at participating retailers to earn cash back. However, a good variety of stores are part of the Ampli network, so you’re bound to find something that will give you a payback.

Pros

-

Easy to use

-

Cash rewards

-

Automatic earnings

-

Stack loyalty program earnings

-

Wide variety of participating retailers, including, food, clothing, drug stores, gas and more.

Cons

-

Must shop at participating merchants to earn cash back

How does Ampli compare?

Ampli is only intended as a shopping rewards app, so it’s not really comparable to popular pre-paid cards like KOHO or Stack.

Ampli does, however, share many characteristics with Drop, another rewards app. Like Ampli, Drop requires users to download an app and link their debit and/or credit cards to earn rewards on everyday purchases. Users then earn points every time they shop at participating retailers. Unlike Ampli, Drop users must take steps to activate an offer to earn a specific reward. If you don’t activate the offer, you won’t earn the rewards. With Ampli, earnings are automatic.

Furthermore, Drop rewards users with points rather than directly with cash and points can only be redeemed as gift certificates for a rather narrow range of specific retailers. Also, you must have a minimum of 25,000 points (equal to $25) to redeem your points for a gift certificate.

Ampli is also similar to Checkout 51, another shopping app. Checkout 51 rewards users with a set cash back amount when they make a specific purchase (usually a grocery or drug store purchase). Unfortunately, while offers can sometimes be quite generous, Checkout 51 requires a lot of effort to use because you have to first select specific offers you like and then upload photos of your receipts before you can receive the reward.

| Features | Ampli | Drop | Checkout 51 |

|---|---|---|---|

| Reward | Cash | Points redeemable for gift cards only | Cash |

| Automatic earnings | Yes | No, must activate a reward | No, must upload receipts |

| Variety of retailers | Yes | Yes, very impressive range of eligible retailers | No, mostly grocery and drug store items |

| Min amount For redemption | $15 | 25,000 points (value of $25) | $20 |

Signing up for Ampli

Signing up for Ampli is quick and easy. You begin by downloading the app from Google Play or Apple App Store. You’ll then be asked for info like your name and email.

Once you confirm your email, your Ampli account will be activated.

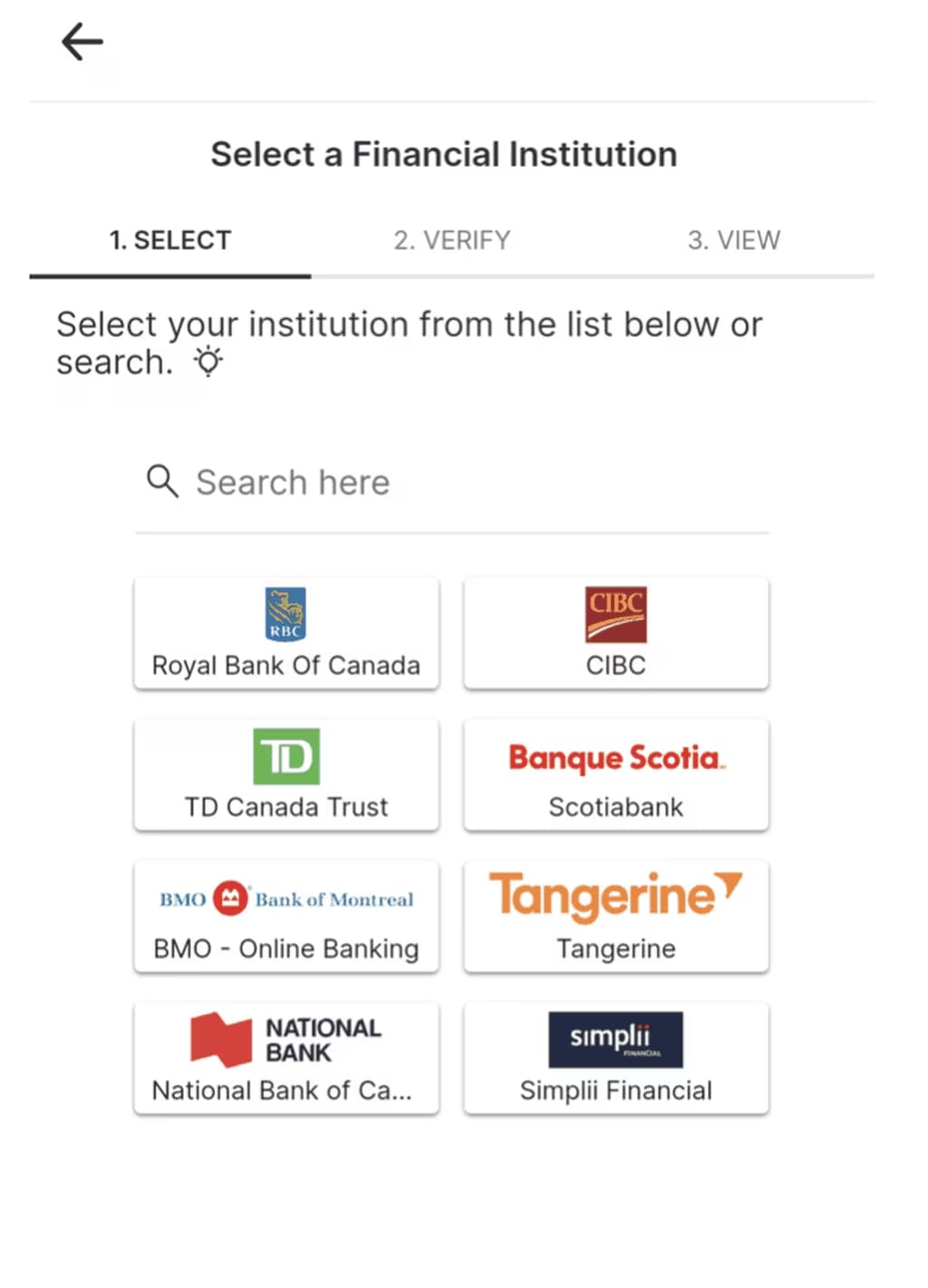

You then just need to link your bank account and/or credit cards. The app uses top encryption tech to protect your data.

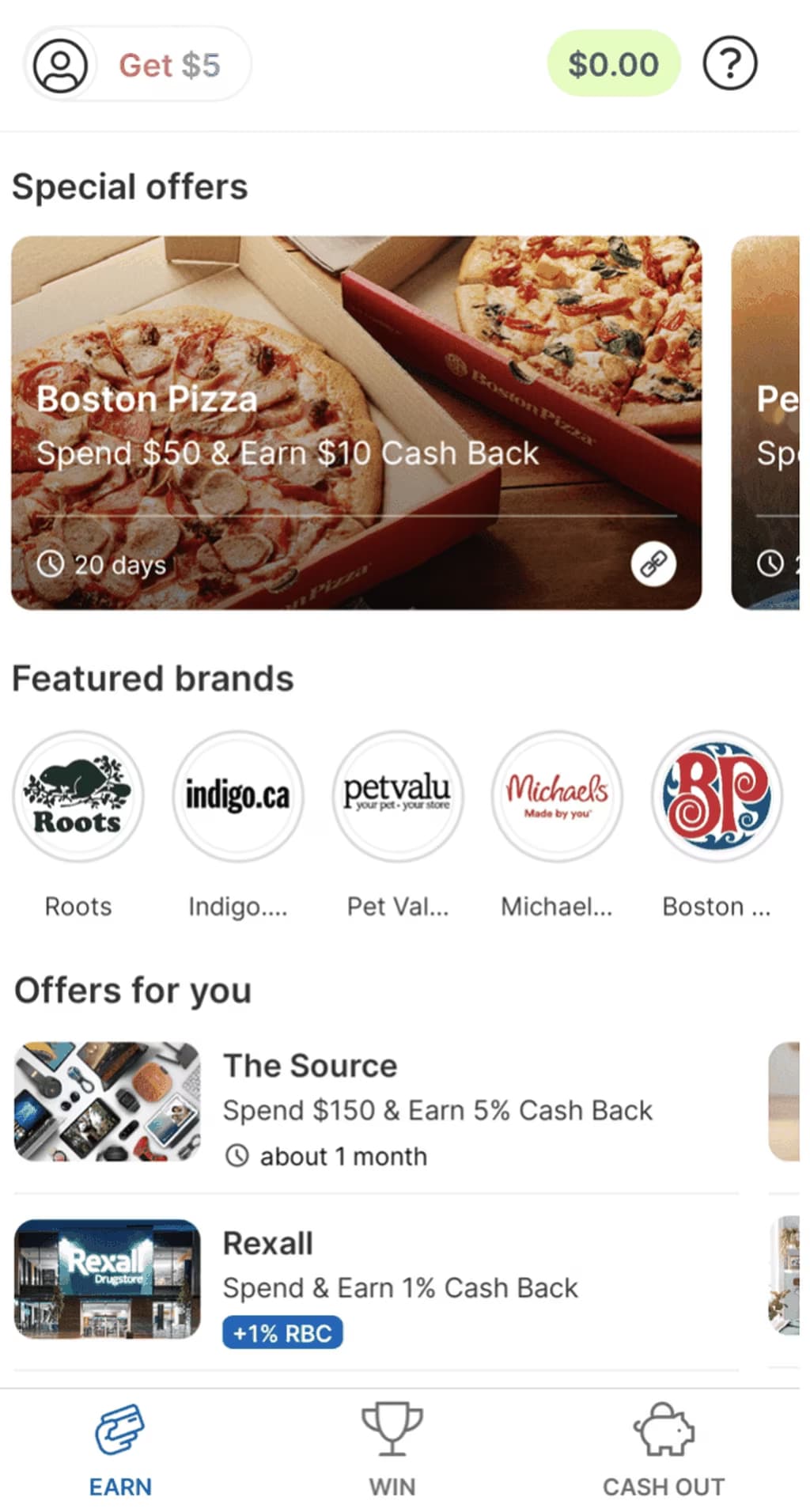

After signing up, you’ll receive offers from participating retailers you can use to earn cash back. Each offer has a set cash back offer (like earning $5 when you spend at least $100 at the Keg) or a percentage amount. Some even feature bonuses like an additional 1% cash back when you use a linked RBC card. Each offer also has conditions that are clearly spelled out like whether or not you can shop online and/or in-store, how often you can use the offer and the minimum spend.

You can cash out once you’ve earned a minimum of $15. Though Ampli is actually a wholly-owned subsidiary of RBC, you don’t need to have an RBC bank account to receive your funds.

The bottom line

We’re fans of this app. Compared to other reward apps like Checkout 51 and Drop, Ampli is the easiest, most passive way to earn money because it requires you to do pretty much nothing aside from shop at a participating store. The fact that it offers cash—a much more flexible and transparent currency than points—is another big bonus. While it doesn’t yet have the very large number of participating retailers that Drop offers, the list of participating brands continues to grow. If you’re looking for a no-effort way to earn cash, Ampli is one of the best money-making apps in Canada.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.