-1692887118.jpg)

Canada's credit unions as online banking options

Vitalii Vodolaszskyi / Shutterstock

Online banking is quickly becoming more and more popular among Canadians. We keep an updated post that looks at the best online banks in Canada. Among other topics, we discuss internet banking and mobile apps offered by some of the leaders in Canada’s online banking world, including Tangerine (from Scotia Bank), EQ Bank (from Equitable Bank), and Simplii Financial (from CIBC). Readers of that post may recall that we also talk briefly about the online high-interest savings accounts offered by a number of credit unions.

Based on the feedback we received on those discussions, we thought we should do a follow-up post exploring Canada’s credit unions in greater detail. While this post does touch upon various aspects of these institutions, its primary objective is to take a closer look at the online/mobile banking platforms available at Canadian credit unions.

Of note is the fact that our discussions will be limited only to personal banking platforms offered by credit unions, and will exclude their Quebec equivalents – Caisses Populaires. Specifically, in this post, we’ll try to answer the question: Do Canadian credit unions offer viable online banking options for Canadians – and how do they stack up against what else is on the market? While a post on credit union branch options is long overdue, it’s not really part of what we’re trying to do here (much to the chagrin of our Manitoba roots!).

The Canadian credit union landscape

Before we do a deep dive into the Canadian credit union landscape, let’s spend some time understanding what these institutions are. For anyone unfamiliar with them, credit unions were born in England in 1844, and made their first appearance in Canada in 1900. The central idea behind Canadian credit unions is that they:

- Are created primarily to serve the financial needs of local communities in and around which they operate

- Typically offer services such as checking and savings accounts, residential and commercial mortgages, insurance products and investment advice

Sounds like your neighbourhood bank, doesn’t it?

While there are other distinguishing characteristics between banks and credit unions, such as “account holders” (banks) versus “shareholders/members” (credit unions), there is one major difference that sets these two types of institutions apart. According to the Canadian Credit Union Association (CCUA), “…every credit union’s Board of Directors consists of democratically elected members from their community”, which means that the credit union is (theoretically) much more in touch with the financial needs and preferences of the constituents they are created to serve.

Today, over 5 million Canadians are served by 290 credit unions nationwide, with almost $216+ billion in consolidated holdings. Within this universe of Canadian credit unions, the top 100 institutions controlled nearly $200 billion in assets, with just 5 large unions accounting for nearly 35.4% ($76.6B) of Canadian credit union assets.

Our post will focus on the online banking platforms offered by these top-5 Canadian credit unions.

At this stage, it may be worth also exploring the geographic distribution and reach of both traditional banks and credit unions through their network of branches across Canada. As you can see, the credit union model has become especially strong in the prairies where Manitoba and Saskatchewan have more credit union branches than bank branches! However, no single one of these prairie credit unions makes our list of largest credit unions by asset size.

Comparing Canada’s online banks to online credit unions

Research conducted by the Canadian Journal of Non-profit and Social Economy Research shows that (as of Autumn 2016) Canadian banks operated 5,388 branches within the designated geographic area of the study, compared to nearly 3,000 credit union branches across the same region.

Canada’s online banking ecosystem has been growing steadily over the years and has become increasingly popular amongst clients.

According to a study by Abacus Data, conducted on behalf of the CBA, the number of users of online and mobile banking platforms has clearly increased, though there definitely seems to be a greater preference for mobile banking emerging. It is this precise trend toward online and mobile banking platforms that credit unions have been tapping into.

Our previous post looked at the online banking options offered by the major online-only banks. When it comes to online banking platforms, based on our own research, we can confirm that the Big Five credit unions (and some of the smaller players) are undeniably stepping up their own online presence, with several launching online-only versions of their credit union.

Here are some general observations that our research concludes:

- All of the Big Five credit unions offer online banking access to their clients.

- All of the Big Five credit unions offer secure mobile banking apps to their members.

- Some of our credit union options even offer members, that are sensitive about downloading and installing software on their devices, the same mobile banking experience without the need to download an app.

- Members wishing to pay their bills online will find online bill payment support on all five platforms.

- All of the Big Five credit unions offer electronic funds transfers.

- Most of the Big Five offer free ATM/ABM access to either their own or other popular ATB/ABM networks. However, in some cases, there is a limit on the number of free transactions, while in other cases there may be a requirement to maintain a minimum chequing account balance to qualify for free ATM/ABM access.

- While many online banking platforms (both banks and credit unions) offer e-Statements FREE, MB-based Cambrian Credit Union (not one of the Big Five) actually pays you $1 every month when you sign up for their Green Online Documents Program!

Some credit unions, like Envision Financial, also enable members to conduct interesting budgetary analyses of their spending habits.

Others, like Coast Capital, offer members comprehensive online savings and money management tools that can be used to plan a budget and develop a savings plan.

Ontario-based Meridian offers an online high-interest savings account calculator to predict how much you can save through one of their accounts using regularly scheduled electronic deposits.

As part of their online banking platforms, some credit unions offer Near Field Communication (NFC) payment support, which can effectively convert your mobile device into a Credit/Debit card by simply swiping it across a payment terminal.

In some cases, we found that the credit unions allowed banking transactions to be downloaded into formats that can then be imported into popular accounting software, but if this is a priority for you, the banks are probably a better bet.

Fees

The Financial Consumer Agency of Canada provides a great tool for Canadians to compare accounts from leading banks and credit unions. Although the tool does not cover the entire Canadian universe of banks and credit unions, it can be effectively used to get a sense of how fees are trending across both types of institutions.

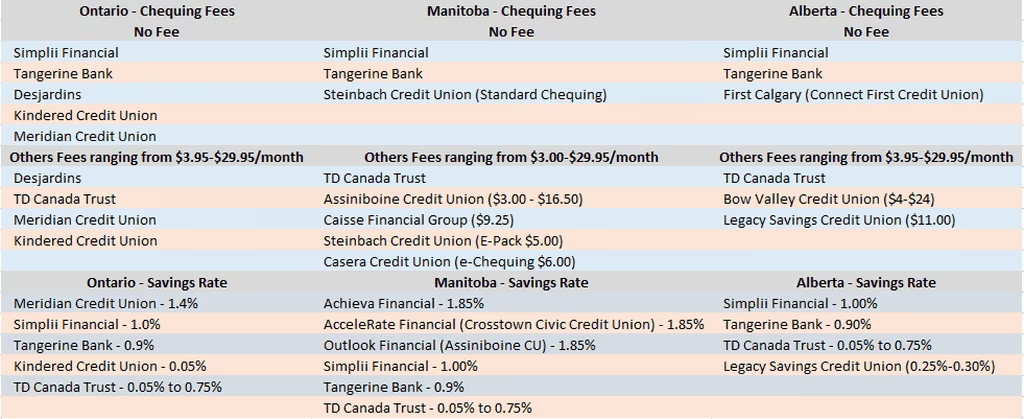

We used the tool to screen bank and credit union Checking and Savings Account fees in British Columbia. Here’s a sub-set of our findings:

While these are the “published” fees and rates, most financial institutions will offer ways to reduce or entirely waive the applicable fees. A look at other popular chequing and Savings products within Canada’s online banking world, across multiple provinces, shows a wide spread between fees charged and interest rates offered on account balances. Doing your homework and seeing what you can negotiate are a big deal.

Many credit unions will offer no-fee banking if you hold a minimum of $1,000 a month in your account. Holding minimum balances will also qualify you for a variety of free transactions, such as Debit Card activity and ATM withdrawals. Some credit unions, such as MB-based Caisse Financial Group, also offer no-fee accounts for specific demographics like students and seniors.

Regulatory framework

Bank depositors, account holders, and credit union members will take great comfort in the fact that Canada’s online banking world is also subject to regulatory protections – the same way their brick-and-mortar cousins are. However, there are certain regulatory protections and provisions that are unique to credit unions, which may weigh on your decision to switch to a credit union or stay with your bank for your online banking needs:

- In most cases, while chartered banks are federally regulated entities (under Canada’s Bank Act), it is provincial regulators that have primary oversight over credit unions in their provinces (under the Cooperative Credit Associations Act)

- While credit unions are, for all intents and purposes, “banks by another name”, federal regulators recently barred them from using “bank”, “banker’ or “banking” when describing themselves. As a prospective credit union member, you must take a closer look at how your future financial institution projects itself, taking care that they don’t run afoul with The Office of the Superintendent of Financial Institutions (OSFI)

- While a major highlight of being a credit union is that it services local members within a provincial jurisdiction, provincial regulations stymie their ability to compete nationwide. The federal government has now put legislation in place that allows credit unions to “continue” their operations across Canada. This means that your favourite credit union will now be able to bring its “provincial focus” to service a nationwide membership base

- Deposits held in Schedule 1 banks are insured by the Canada Deposit Insurance Corporation (CDIC). Such deposits are usually protected up to a limit of $100,000 per depositor. However, if you hold deposits in some provincially regulated credit unions, you may have unlimited protection. For instance, the Deposit Guarantee Corporation of Manitoba (DGCM) provides “…100% guarantee of deposits” held in its credit unions. The same is true for credit union deposits in several other provinces such as Alberta and Saskatchewan. Other provinces, such as Nova Scotia ($250,000) and Ontario ($250,000) have set limits on the amount of statutory protection your deposits enjoy

Another interesting dynamic within the regulatory framework, which might impact who you may choose to do business with (banks or credit unions), relates to the new CMHC-insured mortgage rules. The new rules mandate higher diligence from federally-regulated mortgage lenders (primarily banks) when approving new mortgage applications. As a result, it is likely that many prospective borrowers will now migrate towards non-federally regulated lenders, such as credit unions and caisses populaires.

While you decide on which online banking model you would like to embrace, the one offered by Schedule 1 banks or those available through credit unions, it’s important to factor into that decision the regulatory framework under which these institutions operate. As someone looking to primarily bank online, some provincially regulated credit unions mandate an in-branch visit (to verify identity and establish bona fides of new members), while others allow you to submit your application online.

Your choice of credit unions should therefore also take into consideration how easy (or challenging) it might be to create, maintain and operate your online banking accounts on an ongoing basis.

What’s best for you?

Clearly, based on all the discussions above, Canadian credit unions definitely have a lot to offer, including many services that were traditionally relegated to the big banks. When it comes to which medium of banking you prefer, however, banks or credit unions, it’s often a personal choice. Individual preferences may be based on:

Access to services: Most credit unions have fewer branches within a designated locality or community. Most of the Schedule 1 banks on the other hand have nationwide presences – however, when looking at a purely online format, it’s a wash.

Corporate structure: Banks are structured as dividend-paying bodies to their shareholders, while credit unions re-invest profits into local communities and may also share them with members.

Fees and interest rates: Because they are more community-focused and don’t have tremendous overheads to support, credit unions tend to be more generous in their interest and profit-sharing practices. Many even have very competitive fee structures. Although Canada’s online-only banks have these same advantages.

Membership: While most banks allow all Canadians to open and operate an account, many credit unions have specific requirements for members to be domiciled in the province where the credit union is registered (although this looks to be slowly changing).

Depositor voice: Unless you are a shareholder, you won’t have a say in who has a seat on the board of your bank. With credit unions, all deposit holders/members can vote on who will be appointed to their boards of directors (or can even become a director).

Convenience: Online banking offers exceptional convenience to account holders. While large Canadian banks have invested heavily in technology, credit unions also have a strong fintech footprint – mostly province-wide, with several (like MB-based Achieva Financial), offering branchless banking nation-wide

Protection: While banks offer CDIC protection to an extent of $100,000, many credit unions offer much more safety to their members, ranging from $100,000 to an unlimited amount. In any case, banks are definitely not “safer” than credit unions.

Robo Advisors: If you’re looking for the easiest way to invest your money, credit unions don’t yet have access to robo advisors such as BMO SmartFolio or RBC InvestEase.

In a recent Ipsos Survey measuring financial services excellence in Canada, the overall Customer Service Excellence award for 2017 was earned by an aggregate of credit unions nationwide.

Within credit unions, if you value the ability to directly import your transactions into your personal financial accounting software (.Qif or .Ofx formats for QuickBooks, Simply Accounting, Quicken, MS Money), then Coast Capital might be the one for you. For those of you looking for high interest on your savings, MB-based Achieve will likely provide you with what you value most.

Overall, I definitely recommend comparing your credit union options to the top online banks like Simplii and Tangerine in order to see what fits your needs best. This is especially true if you’re a first-time homebuyer that could benefit from the new housing regulations placed on Schedule 1 banks. As online-only consumers, we just keep cheering for more competition, as that will inevitably lead to better prices, better platforms, and better overall service from Canada’s online banks and credit unions.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.