Financial literacy basics: Investment fees decoded

Sauko Andrei / Shutterstock

Decoding investment fees isn't as tricky as you might think. Knowing what you’re paying in investment fees starts with learning how to read Fund Facts and investment statements. We'll show you how to tackle this financial literacy essential.

How much do your investments cost?

It seems like a straightforward question, but if you’re like most Canadian investors, you might not have a hot clue about investment fees and other charges related to the advice you may or may not receive. MER, management fee, DSC – it’s all a mystery to many investors. And why bother to crack the code? Indeed, a survey released by the Mutual Fund Dealers Association of Canada (MFDA) showed that fewer than 20% of Canadian investors could correctly identify all the fees that were included in their investment statements.

It’s a problem. Canadians pay some of the highest investment fees in the world, according to Morningstar’s biennial study on the Global Investor Experience. So, you could be paying out the nose and not even know it. The (sort of) good news is that we improved from dead last in the 2017 study to “below average” in the 2019 study.

Knowing what you’re paying in investment fees is an important part of achieving financial literacy. You (hopefully) wouldn’t buy a car or home without checking out the price tag, right? If you’re confused by investing fees, you’re not alone and I’ll show you exactly how fees are charged through the various advice channels available to Canadian investors.

Why fees matter

It’s important for investors to understand the investment fees they pay because fees have a direct correlation to performance. Morningstar’s Ian Tam said that the impact of a 2% fee results in a difference of 33% less wealth after 20 years when compared to no fees. That’s 1/3 of your portfolio vanishing because of high investment fees.

Furthermore, research from Morningstar shows that a fund’s expense ratio is the most proven predictor of future returns. That’s because low-cost funds have a better chance of surviving and outperforming their more expensive peers. Fees are also one of the easiest factors for investors to control since we know in advance how much the fund costs. We can’t say as much about a fund’s future performance.

If you have A-Series mutual funds

Most Canadians invest in mutual funds purchased through a bank or investment firm. The latest statistics show nearly $2 trillion invested in mutual fund assets, compared to just $318 billion held in exchange-traded funds (ETFs).

Mutual funds are sold in a variety of ‘classes’ with the most widely available being the Advisor-class or A-series funds. According to Morningstar, the median fee for a balanced A-series mutual fund is around 2.04%.

The advisors working at these banks and investment dealers are typically commission-based and the mutual fund fee structure supports this by paying a trailing commission to the advisor and their firm for ongoing advice.

The fee for an equity mutual fund might break down like this:

- Administrative fee (overhead) – 0.25%

- Investment manager fee – 1.00%

- Trailing commission (split between advisor and firm) – 1.00%

- = Total management expense ratio (MER) – 2.25%

Most equity mutual funds pay a 1% trailing commission to the advisor and firm, while income or bond mutual funds pay a 0.5% trailing commission. The benefit to most investors is the low barrier to entry. Literally walk into any bank branch and you could start investing with as little as $25 per month.

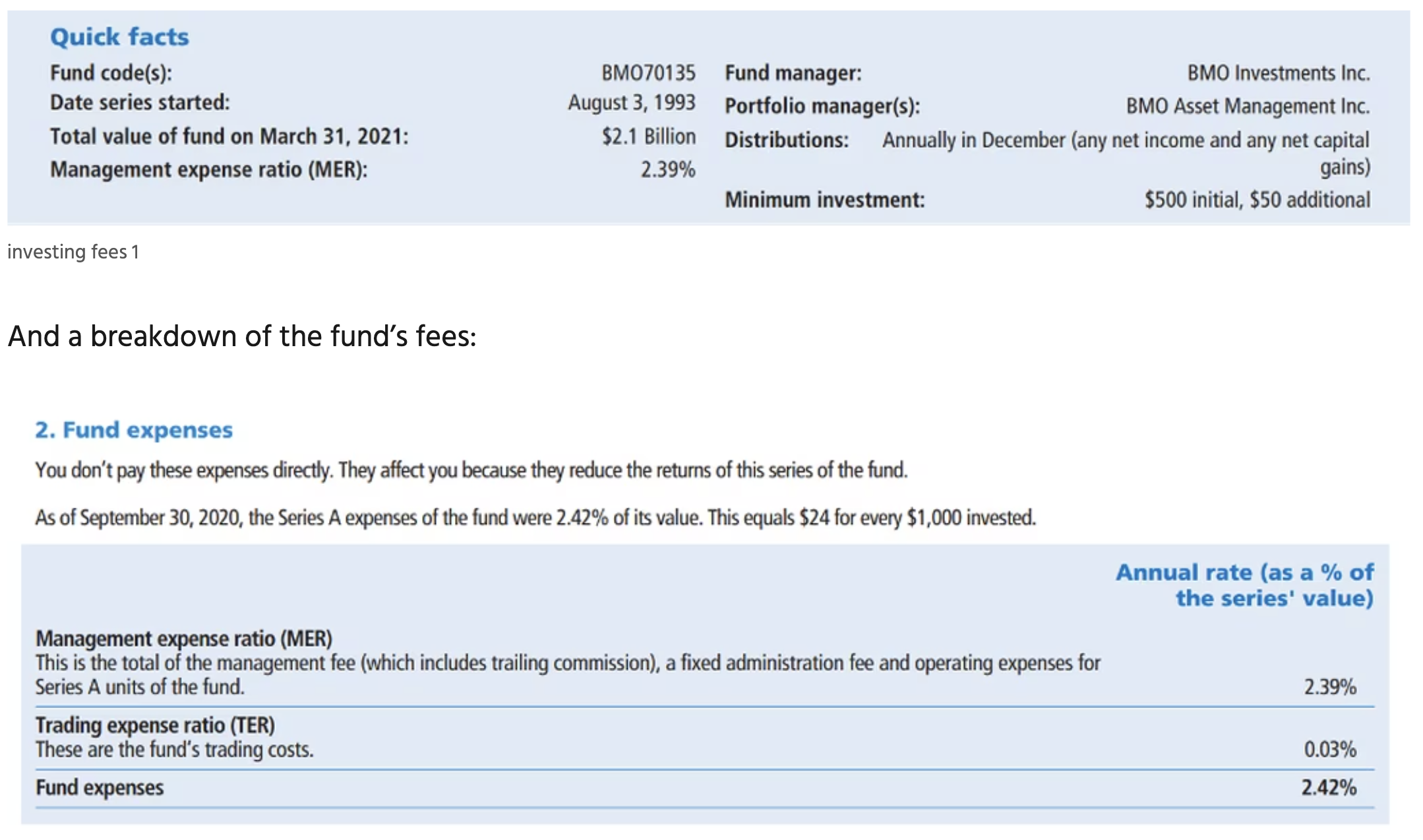

How to find the fees:

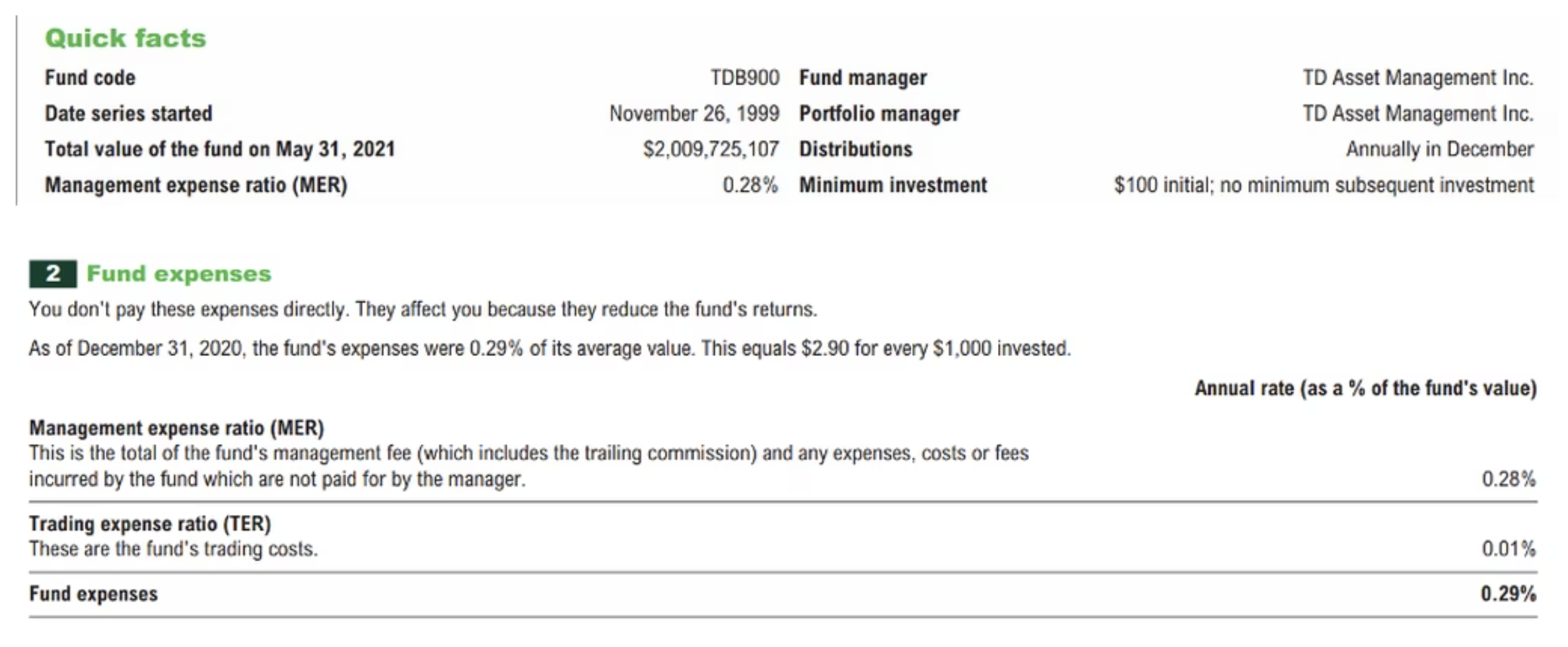

Every mutual fund has a Fund Facts document that outlines the fund’s objective, risk rating, investment holdings, and fees. Search the name of the mutual fund or the ‘fund code’ to find the appropriate Fund Facts document.

You’ll see quick facts:

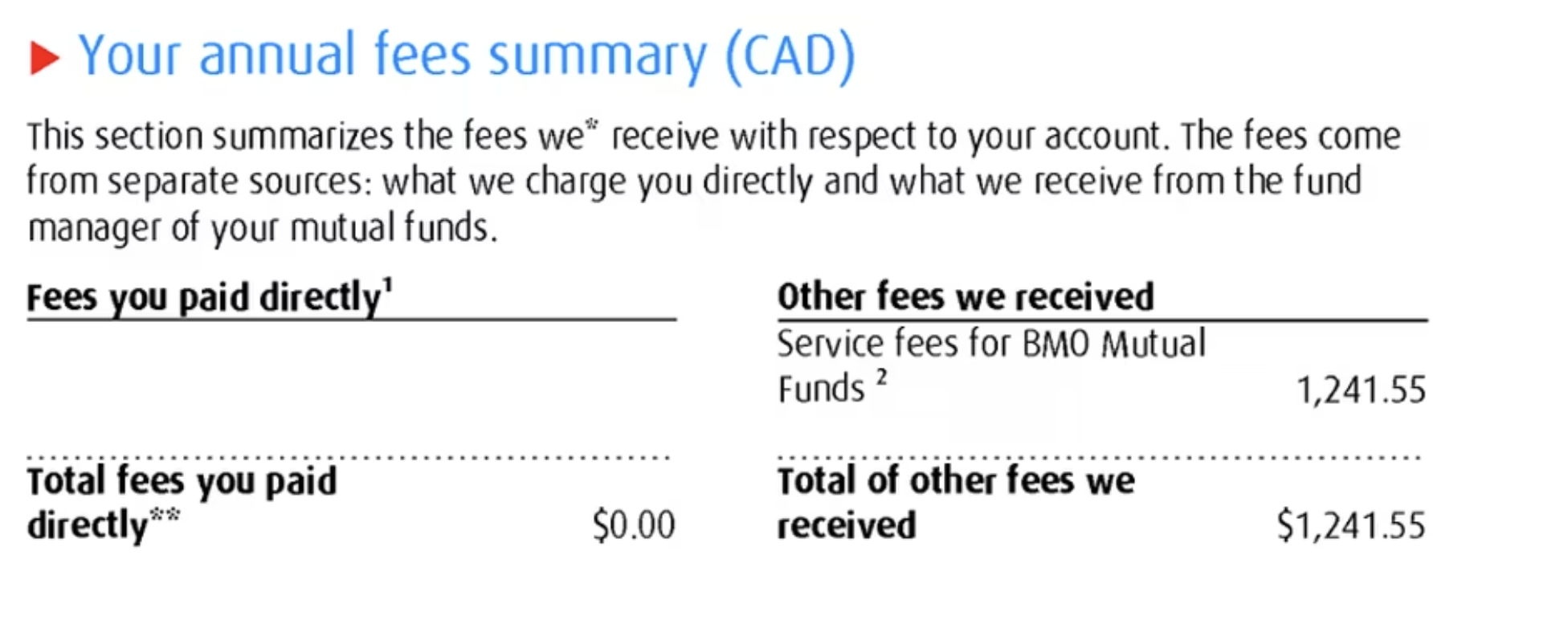

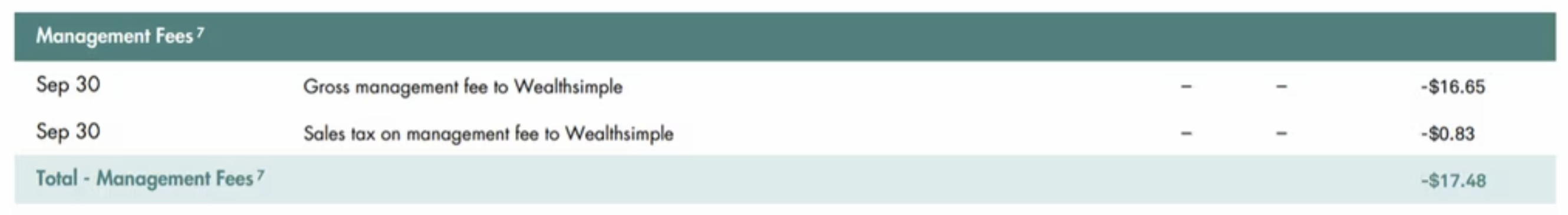

The Fund Facts document is helpful to find relevant information on the specific mutual fund(s) you’re invested in, but there’s another way to find the fees you’re paying and that’s on your investment statement that you receive every month:

Here you can see your fees expressed in dollar terms rather than in percentages, which provides helpful context for investors. It’s important to note that investors don’t pay these fees directly, instead they reduce the returns of the fund.

If you have F-Series mutual funds

Investors can access F-series funds if they enter into a relationship with a fee-based advisor. F-series funds strip out the trailing commission and don’t pay anything to the advisor. That means the fee-based advisor charges their clients directly, typically in the range of 1% or less.

The benefit of using a fee-based advisor is that they tend to have access to a wider range of investments, including lower-cost funds. So, even though you might pay the same 1% fee to your fee-based advisor, they could potentially reduce your fees by sourcing out cheaper funds – say with an average of 0.50% – meaning you save 0.75% from our A-series example above.

- Fee-based advisor fee – 1.00%

- Product cost – 0.50%

- = Total management expense ratio (MER) – 1.50%

The challenge of moving from a commission-based fee model at the bank to a fee-based model with an independent advisor is that there may be a minimum portfolio size required to access fee-based advice. This threshold can start as high as $500,000.

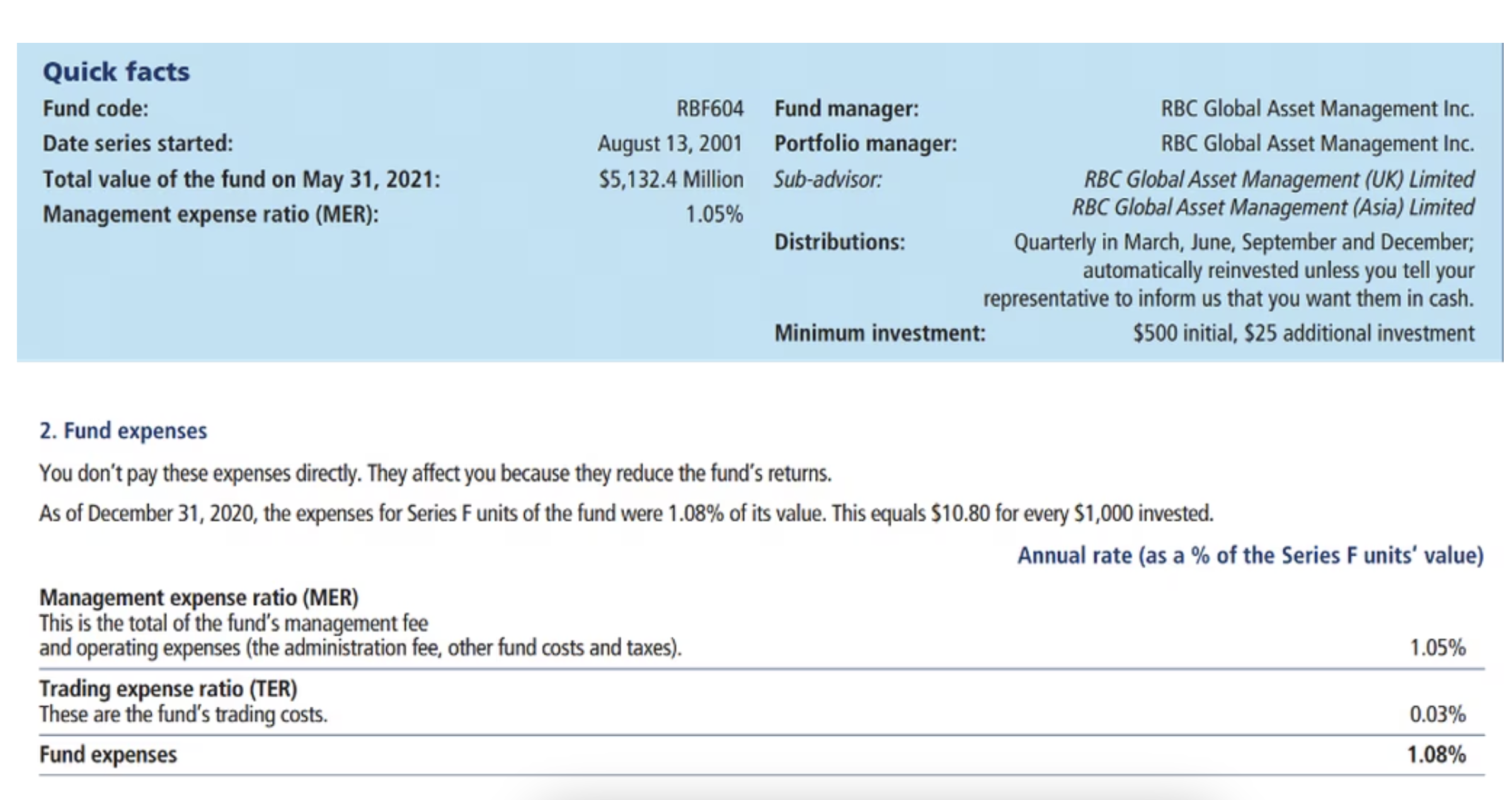

How to find the fees:

Once again, you’d look for the Fund Fact sheet for the specific F-series mutual fund you’re interested in. You’ll find the quick facts on the fund, plus the explanation of fees:

Note the much lower management expense ratio (MER) on the F-series funds. That’s specifically related to the fact that F-series funds do not include an embedded trailer fee paid back to the advisor and firm.

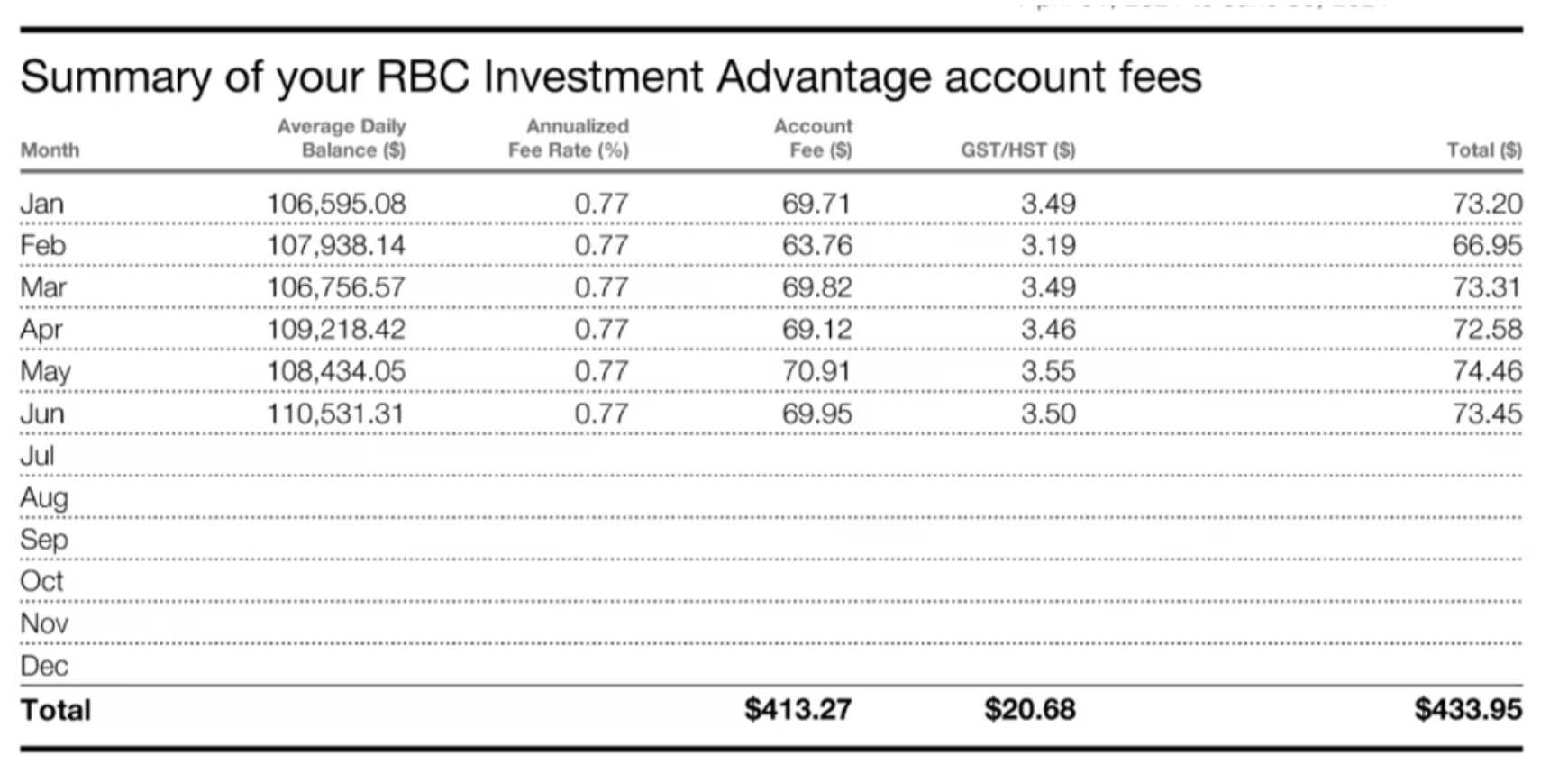

Finally, you’ll see your fees expressed in dollar terms inside your monthly investment statements:

If you have D-Series mutual funds

D-Series mutual funds are a low-cost fund series designed specifically for do-it-yourself investors. These funds are cheaper because they don’t include an ongoing trailer fee. That makes sense because do-it-yourself investors shouldn’t be paying for advice that they’re not receiving.

Investors can’t access D-series funds through their bank – they must be bought through a self-directed platform.

One example is the TD Balanced Growth Mutual Fund. The A-Series version comes with a total MER of 2.24%, while the D-series version of the same fund comes with a total MER of 1.47%.

TD has a more striking example with its popular e-Series funds, which can only be purchased online through a discount brokerage platform. These e-Series funds come with extremely low MERs, ranging from 0.28% to 0.50%.

How to find the fees:

Search the mutual fund name or fund code to find its Fund Facts document. Here you’ll find the relevant quick facts along with a breakdown of fees:

With a self-directed platform, you’ll need to wait for the December year-end annual performance and fees and charges report to see the breakdown of fees paid related to D-series and E-series mutual funds.

If you have a robo advisor

Robo advisors (or digital advisors) offer a way for investors to access a diversified portfolio of lower-cost products without having to manage their own investments. Known as a hybrid solution between a managed mutual fund account and a do-it-yourself approach, a robo advisor will build, monitor, and rebalance a risk-appropriate portfolio of exchange-traded funds on behalf of their clients. Wealthsimple is an example of a reputable robo advisor in Canada.

There are two layers of investment fees with this approach. The robo advisor charges a management fee, typically between 0.40% and 0.50%, plus the cost of the products used to build the portfolio. These product costs can range from 0.15% to 0.30%.

The cost breakdown would look like this:

- Robo advisor management fee – 0.50%

- Product cost – 0.25%

- = Total management expense ratio (MER) – 0.75%

Robo advisors are indeed a nice in-between solution for investors looking to reduce their investment fees while still getting access to a professionally managed portfolio of products.

How to find the fees:

Every robo advisor should list its management fee along with an estimate of the product fees for the ETFs used to build your portfolio.

For existing robo advisor clients you’d find the fees listed in your monthly statement:

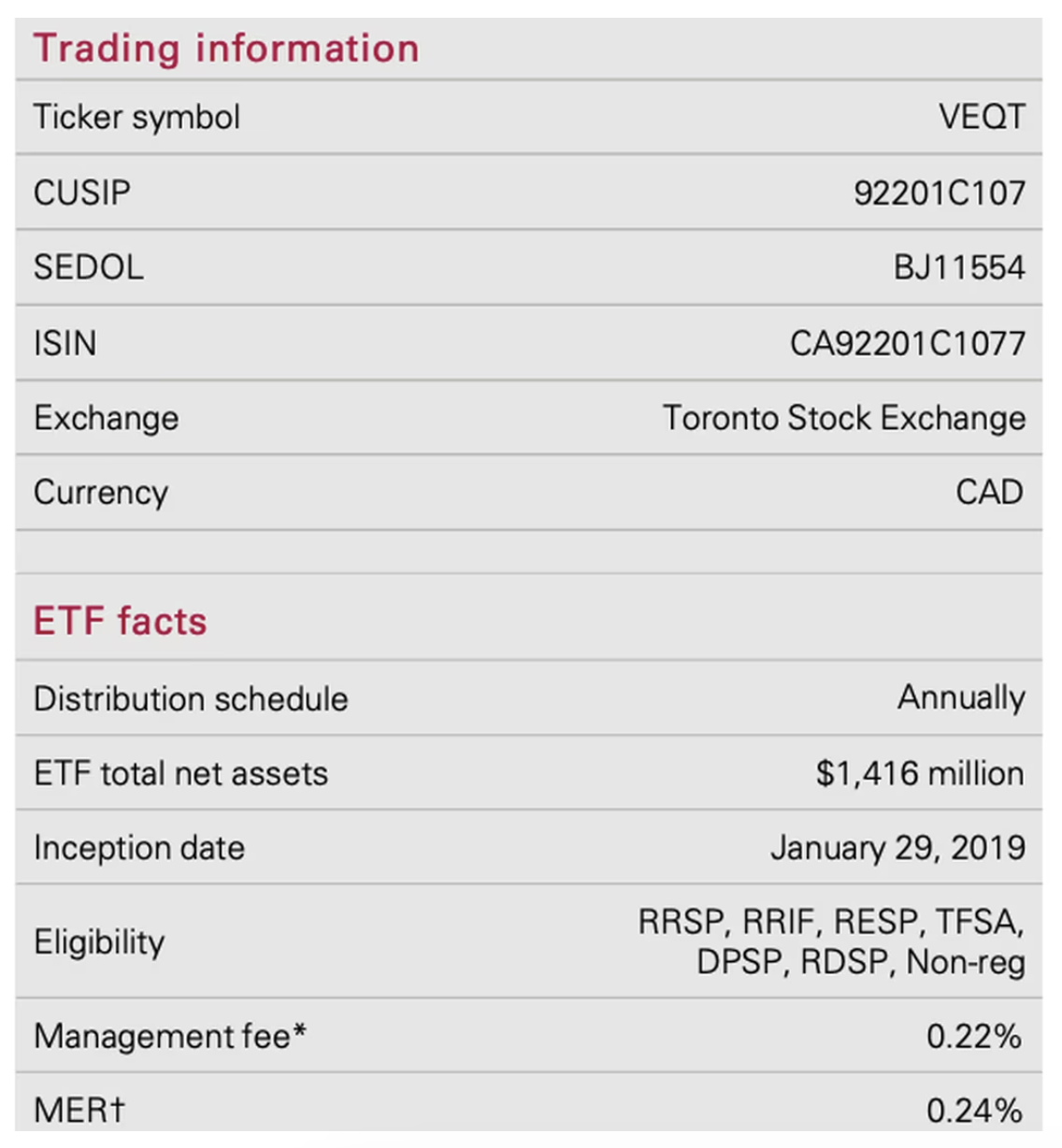

If you have Exchange-Traded Funds (ETFs)

ETFs are growing in popularity for both fee-based advisors and do-it-yourself investors. ETFs tend to have much lower investment fees than mutual funds and can be purchased commission-free at several online brokers. Note that ETFs cannot be purchased at your local bank branch or investment dealer, as the advisors at this level are only licensed to sell mutual funds.

Just like mutual funds, ETFs will have a total cost or MER that includes a fee paid to the fund manager, plus administrative or overhead costs, and potentially some trading expenses.

Most ETFs passively track an index that represents a geographic region or a particular sector. A passively managed fund doesn’t need to pay expensive investment managers to beat the market, so they can pass those savings along to the investor.

A typical cost breakdown would look like this:

- Management fee – 0.22%

- Operating expenses – 0.03%

- = Total MER – 0.25%

As ETFs grow in popularity, we’re seeing more and more actively managed products and specific ‘sector’ ETFs tracking trends like innovation and clean energy, to name a few. Since these funds typically use a star fund manager to execute their vision, investors should expect to pay higher investment fees than they would with a plain vanilla ETF that’s passively tracking the market.

An example is QQQ, an ETF that passively tracks the NASDAQ 100 index for a fee of 0.20%, versus Cathie Wood’s ARK Innovation ETF, ARKK, which aims to invest in disruptive technology companies and comes with an MER of 0.75%.

How to find the fees:

ETFs must also have a Fund Facts document and that’s where you’ll find a quick summary of the ETF along with a description of the fees you’ll incur by investing in the product:

READ MORE: An intro to ETF investing

Understanding CRM2 and fee disclosure

The reason why investors can even find a list of fees on their investment statements is because of a regulatory initiative known as the Client Relationship Model, phase 2 – or CRM2 – that came into effect in 2016 requiring investment firms to better disclose fees and performance. Prior to CRM2, it was common for firms to express fees in percentage terms (i.e. 2% MER) rather than also disclosing the dollar amount.

Now, it’s required that investment statements clearly disclose fees and performance. Fees and other charges are to be itemized, including everything from trailing commissions, redemption fees, switch fees, and administration fees. The report is also supposed to provide a total dollar figure for the year, rather than simply using a percentage like the MER on a product.

Unfortunately, the mandatory fee disclosure and performance reporting seem to have done little to improve investors’ understanding of concepts like trailing commissions, deferred sales charges, and third-party compensation. Investors are still largely in the dark when it comes to the investment fees they pay.

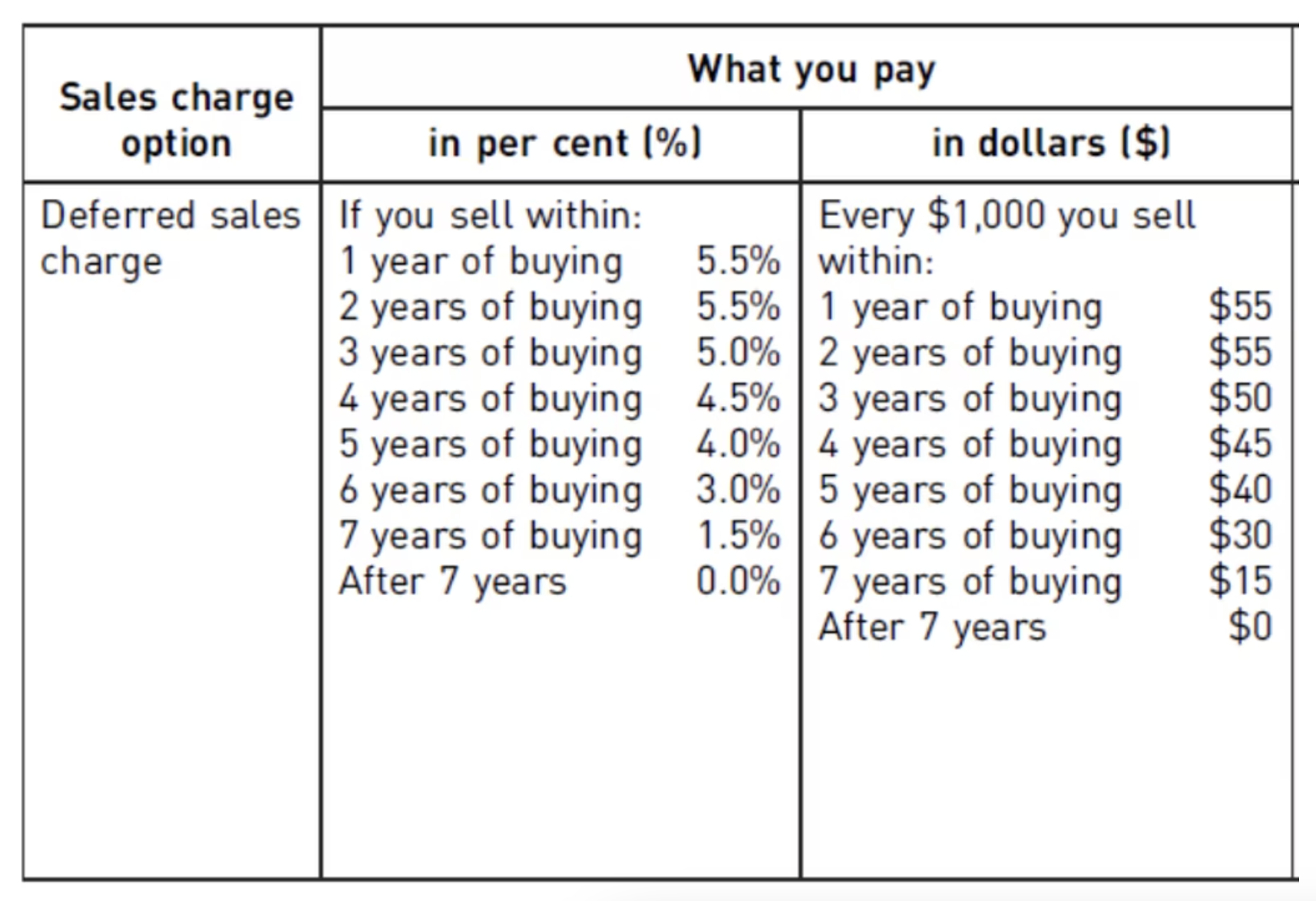

Understanding Deferred Sales Charges (DSC)

Deferred sales charges (DSC) are a way for advisors to earn a commission upfront when investors first purchase a mutual fund – typically 5%. If the investor redeemed or sold the fund before a certain time, they would be charged a fee based on a sliding scale. This was a way for mutual fund companies to recoup the upfront commission they paid to the advisor. After seven years, the investor could redeem or sell the funds without penalty.

Thankfully, this insidious fee will be going away as of June 21, 2022. The Canadian Securities Administrators (CSA) has banned the practice of paying upfront sales commissions (known as deferred sales charges).

Investors may still see DSC funds listed on their statements. That’s because the ban on DSC funds will only apply to new funds sold, not to funds already in the deferred sales charge schedule.

Note that you can transfer out 10% of the balance of your fund each year fee-free under the DSC schedule, so if you find yourself stuck in DSC hell for a few more years you can at least get some portion of your portfolio out without penalty.

How to find the fees:

Look to the Fund Facts document to find out if your mutual fund was sold to you with a deferred sales charge schedule. If it was, you should see the schedule laid out like this:

On your investment statement, you should also see the specific mutual fund with the letters DSC listed beside the name – a dead giveaway that you’re caught in the dreaded DSC cycle.

The bottom line

So, should everyone ditch their financial advisor and just build their own portfolio of low-cost ETFs? Of course not.

Financial advisors can add value, just not in the way they often proclaim. Your advisor can earn their keep by providing financial planning and retirement guidance, being tax-aware, helping you manage risk with appropriate insurance and estate planning, supporting you prioritize your goals, and acting as a behaviour coach to steer you through a rough patch in the market.

If investing has been solved with low-cost passive indexing, then your advisor should worry less about picking winning funds and timing the market and worry more about everything else that goes into a sound financial plan.

Investors who are getting good value from their advisor should feel comfortable paying investment fees in the range of 0.75% to 1.25%. Investors who are getting one phone call a year from their advisor during RRSP season should look for other options.

Finally, if you’re the type of investor who’s comfortable managing your own portfolio, you can cut your investment fees to the bone by opening an online brokerage account and buying your own low-cost ETFs. You can even purchase ETFs for free using Questrade or Wealthsimple Trade.

READ MORE: Management Fee vs. MER

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.