Investing in gold: A better investment when you know what you're doing

Watchara Ritjan / Shutterstock

Updated: January 26, 2024

Investors often use gold as a hedge against stock market volatility, inflation, or currency weakness. While the jury is out on whether investing in gold in Canada actually provides any benefits against these calamities, investors have been piling into gold lately and driving prices near an all-time high.

In this article, we’ll look at how to invest in gold and whether you should include gold in a diversified portfolio.

Why invest in gold?

While gold is known as a good store of value, it is also considered to be a speculative and highly volatile investment. Unlike stocks or real estate, gold doesn’t produce income. Its future value is tied to price speculation rather than earnings or dividends. Warren Buffett said this about gold:

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility.”

Still, gold investors have made a mint over two decades, with an annual average return of 9.7% from 2000 to 2020. However, in the last year, due to high inflation and geopolitical uncertainty, analysts have been cautious about the outlook for the gold market. Still, gold is considered a safe investment and acts as a safety net when markets are volatile.

Let’s look at the history of gold as an investment.

How to invest in gold

There are several direct and indirect ways for investors to invest in gold in Canada. You can buy gold stocks – the companies that mine gold. You can buy a gold ETF that tracks the price of gold. Or, you can take physical ownership of gold through coins, bars, or bullion.

The best way to start investing in gold stocks or ETFs is to open a discount brokerage account because you can monitor your investments easily and save money on commission and trading fees. I recommend going with CIBC Investor's Edge, Questrade, or Wealthsimple Trade.

| CIBC Investor's Edge review | Questrade review | Wealthsimple review |

|---|---|---|

|

|

|

|

◦ In-depth research to boost your investment knowledge.

◦ Investment options for every investor, no matter what your financial goals are. ◦ Under 25? Trade for free. |

◦ Buy any North American-listed ETF, including crypto ETFs, commission-free.

◦ No maximum on the amount of free ETFs you can buy. ◦ No minimum investment amount required on ETF orders. |

◦ No account minimums

◦ $0 commission ETF trading ◦ Reinvest dividends automatically |

| Buy gold | Buy gold | Buy gold |

Let’s take a closer look at how to add gold to your portfolio through these various investments.

Related: Best online brokers in Canada

1. Buy gold stocks

Canada is rich in resources, so it’s no surprise that gold mining companies make up a large portion of the Canadian stock market. Here are the top gold stocks listed on the S&P/TSX 60:

Newmont Corp. (NGT/NEM)

Barrick Gold Corp. (ABX)

Franco Nevada Cor.p (FNV)

Agnico Eagle Mines Ltd. (AEM)

Kirkland Lake Gold (KL)

Here are these top 5 gold stocks with up to date analysis on each.

In theory, it should be expected that the profits and stock prices of these individual gold mining companies should rise and fall with the price of gold. But that’s not always the case when picking individual stocks.

Despite a deep downturn earlier this year, Newmont Corp. has been able to hold on to a top spot in gold stocks. Similarly, for the past year, Barrick Gold Corp. has managed to remain a major dividend-paying stock. Keep that in mind as you make your gold stock picks.

2. Purchase gold ETFs

Gold ETFs can be a better way to get broad exposure to gold without the risk of investing in individual companies. Some gold ETFs are backed by physical gold (bullion) stored in vaults, others track gold futures, and some invest directly in the companies that mine the precious metal.

The largest gold ETF is SPDR Gold Trust (GLD), with nearly $70 billion in assets under management. GLD holds physical gold bullion, and its price tends to move in lock step with the spot price of gold.

In Canada, iShares’ Gold Bullion ETF (CGL) also holds physical gold bullion and is designed to replicate the performance of the price of gold.

Horizon Gold ETF (HUG) looks for investment results with gold futures contracts or paper gold. Any U.S. dollar gains or losses will be hedged back to Canadian dollars, which is important because it offers no protection for Canadian investors against a falling U.S. currency.

iShares S&P/TSX Global Gold Index ETF (XGD) essentially tracks the S&P/TSX Global Gold Index. With an MER of 0.61%, XGD looks like a solid alternative to speculating on individual gold mining companies.

Investors should also know that by purchasing a Canadian index fund or ETF, they automatically get exposure to gold in their portfolios. Doing so reduces the risk of trying to pick a winning gold stock.

Click here to see our list of recommended ETFs in Canada.

3. Get gold coins

Investors can also get exposure to gold by purchasing and storing gold coins directly.

The Canadian Gold Maple Leaf is a gold coin produced annually by the Royal Canadian Mint. The gold coin is legal tender with a face value of $50 CAD.

The Mint produces several 99.99% pure gold coins ranging from one gram to one ounce. In 2007, the Mint produced the world’s first $1M coin, which weighed 100 kilograms and had a metal value of over $3.5M.

4. Buy physical gold

The most traditional way to invest in gold is by purchasing gold bullion, which can be either traditional gold bars or gold coins. You can get gold bars in various weights and sizes, ranging from one gram to 400 ounces. In Canada, investors can buy gold bars online through CIBC Precious Metals or in branches at CIBC.

As of the writing of this article, a one-ounce gold bar costs just over $2,000 CAD. Gold and other precious metals are exempt from GST and HST.

Aside from bullion, you can also buy gold in the form of jewellery. Unlike coins or bullion, jewellery can have artistic or sentimental value, so it isn’t only a financial investment but a personal one, too, with a more utilitarian value. Not only that, but gold jewellery that you have on hand can come in handy if you’re ever in a bind and need to sell it for some cash. But, when purchasing gold jewellery, make sure you do your research to know what karat gold you’re buying since that can affect the value and that you’re purchasing from a reputable vendor.

History of gold prices

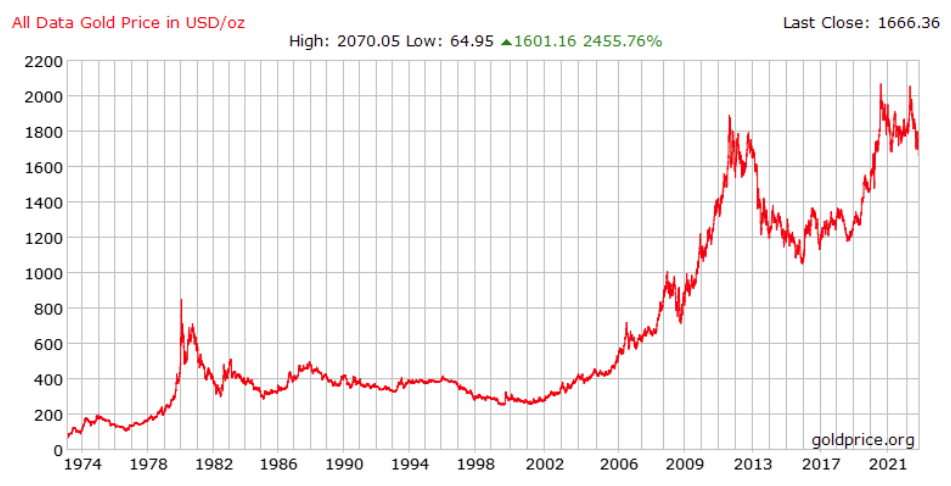

The history of gold prices as an investment dates back to the 1970s when the U.S. and other countries abandoned the gold standard monetary policy and let the price of gold fluctuate in the private market.

The price shot up from less than $200 per ounce to more than $850 per ounce by 1980. From there, the price of gold collapsed and rarely crossed the $400 per ounce mark until 2005, when it began a strong upward trajectory and reached an all-time high of $1,889.70 per ounce in 2011.

Gold prices have been largely disappointing since then as stocks around the world entered a raging bull market for the past 10 years. Since 2010, the S&P 500 has gained 250%, while gold has increased by just 50%.

But that trend started changing thanks to the global coronavirus pandemic. In 2020, the price of gold was up 23.61%, while the S&P 500 was up 16.26%.

Risk and rewards of investing in gold

Diversified investors look for ways to build their portfolio with non-correlated assets – or investments that don’t move in relation to one another. That way, when one asset class goes down, the other asset class either goes up or stays flat, with the goal of avoiding significant losses during market declines.

Gold certainly fits the bill. As we saw in 2020, stock markets experienced enormous volatility – plunging 30% in one month alone. And, while stocks were plunging, gold prices rose higher.

But, once again, gold does not produce any income. Its price is tied to investor speculation. That makes gold highly volatile as an investment and one that could fall to $1,000 or just as easily surpass $2,000 in the coming months or years.

Additionally, while owning physical gold has some appeal, I’m not one to advocate for burying gold bars in your backyard as a hedge against the end of the world. There’s considerable risk in taking physical ownership of gold bars, coins, or even certificates. They could get lost, damaged, or stolen.

I’d also avoid speculating on individual gold mining companies – especially junior ones without a long track record of performance. It makes much more sense to get your gold exposure through a low-cost gold ETF backed by physical gold (stored in secure vaults), which tends to move with the spot price of gold. If you can’t resist the allure of individual stocks, stick with the big names like Barrick Gold or Kinross that have proven operations and performance.

That said, you can’t deny the strong past performance of gold as an investment over the past 20 years. The question is how much to allocate to your portfolio.

Related: How to start investing the smart way

When should you invest in gold?

Investors should dedicate a portion of their portfolio to gold if they believe that gold is a non-correlated asset to stocks and that it also provides a hedge against inflation and currency weakness. Adding gold to your portfolio during periods of uncertainty can make a lot of sense for any diversified investor.

Gold makes up 7.5% of Ray Dalio’s famous All-Weather Portfolio. He does this through the ETF GLD. When you consider gold’s relationship to stocks, inflation, and currency, this percentage sounds about right.

What is gold even worth?

Going back to a Warren Buffett example about investing in gold, the Oracle of Omaha explained that the world’s gold stock was worth about $9.6 trillion U.S. dollars.

For that amount of money, Buffett explained, you could buy all of the cropland in the United States – 400 million acres with roughly $200 billion of annual output – and 16 Exxon Mobils – each one earning $40 billion annually. Still, after buying those assets, there are $1 trillion U.S. dollars in cash left over.

A century from now, the 400 million acres of farmland will have produced massive output. Exxon will have produced trillions of dollars in profits for shareholders while also growing its assets to be worth many more trillions.

The gold, on the other hand, will have remained unchanged in size and will still be unable to produce anything.

“You can fondle the gold, but it will not respond,” said Buffett.

Should I be investing in gold today?

There are many ways for investors to buy gold. And, in periods of economic uncertainty like today, gold can certainly have a place in an investor’s portfolio. Your own allocation to gold will vary depending on how optimistic or pessimistic you are about the global economy.

There are also many views about the future of investing in gold. Gold ‘bears’ are skeptical and always see a gold bubble about to burst. This makes sense when you look back at the boom and bust nature of gold prices over the past 50 years. Gold ‘bulls’ believe gold is a safe haven and worth holding in any diversified portfolio.

Then there are the ‘doomsdayers’ and skeptics who believe the world economy and fiat currency are about to collapse. These investors are more likely to hoard physical gold in their homes, vaults, or backyard bunkers.

My final thoughts

Gold is an intriguing investment option, and I wouldn’t bat an eye if an investor saw the need to dedicate a small percentage of their portfolio to gold (5% to 10%). But gold isn’t for me. I’m still a young investor (41) with a relatively long time horizon ahead of me. I believe in stocks for the long run and that global stock markets will provide the highest returns over the long term. I’m not concerned about a collapsing economy, and if that were to happen, we’d have bigger things to worry about than who has a bunch of gold bars buried in their yard.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.