Questwealth Portfolios review

Money.ca / Money.ca

Updated: January 30, 2024

Questwealth Portfolios review

Quick Facts

If you’re looking for a low-cost, easy investment strategy that won’t demand much of your time or attention, Questwealth Portfolios is among the best (and cheapest) robo-advisors in Canada.

Questwealth Portfolios is the robo-advisor offered by Questrade, a Canadian online brokerage. Questwealth offers a variety of ETF portfolios best suited for those who are comfortable with an algorithm-based, passive management approach to investing. If you’d like to instead dabble in actively managing your own investments, you can do so via Questrade’s self-directed accounts.

What is Questwealth portfolios?

Questrade was founded in Toronto in 1999 as a discount brokerage and soon grew to be the country’s biggest independent brokerage firm (presently it manages over $9B worth of assets). In 2018, they renamed their robo-advisor division Questwealth Portfolios (from Portfolio IQ). Questrade is a member of the Canadian Investor Protection Fund, so accounts are protected up to $1,000,000 if Questrade goes bankrupt.

Portfolios can be put into different types of accounts, including TFSAs, RRSPs, RIFs, RESPs, cash and more. For the socially conscious, Questwealth offers socially responsible investing portfolios that include social and corporate governance ETFs, low carbon ETFs and Cleantech ETFs.

Start investing with Questwealth PortfoliosGetting started with Questwealth Portfolios

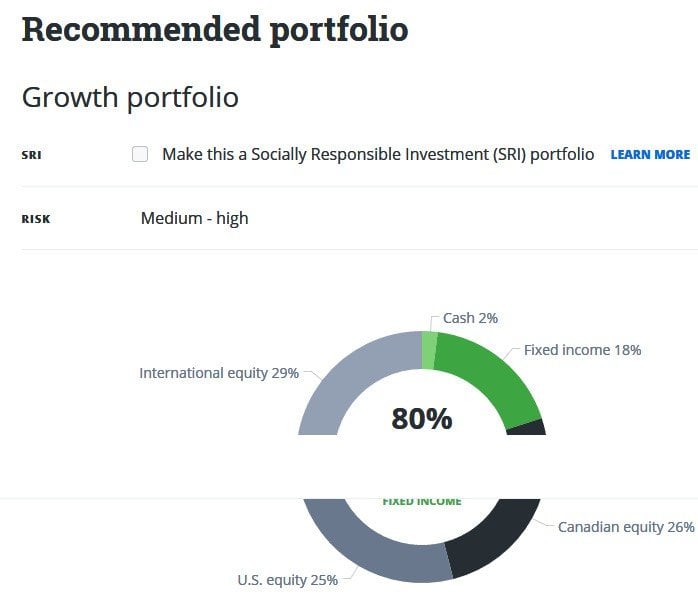

Questwealth matches new users to a portfolio based on your responses to a 10-question form, covering your income, net worth, objectives, investment knowledge, reaction to volatility and more. Investors are then placed into one of five categories: Aggressive, Growth, Balanced, Income and Conservative. For me, after doing the survey, Questwealth recommended the Growth portfolio with medium to high risk and 80% equity and 20% income. This does indeed jibe with my investment style—I can handle some risk, as long as it isn’t heart-attack inducing. Someone who is extremely risk adverse would probably fall into the Conservative category.

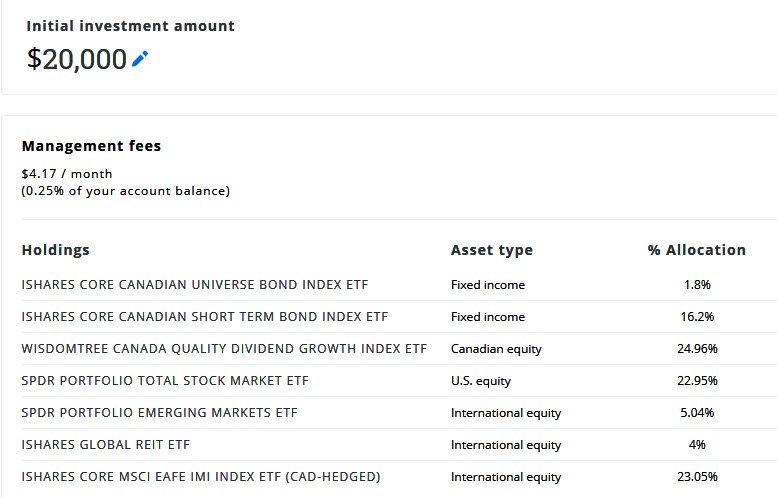

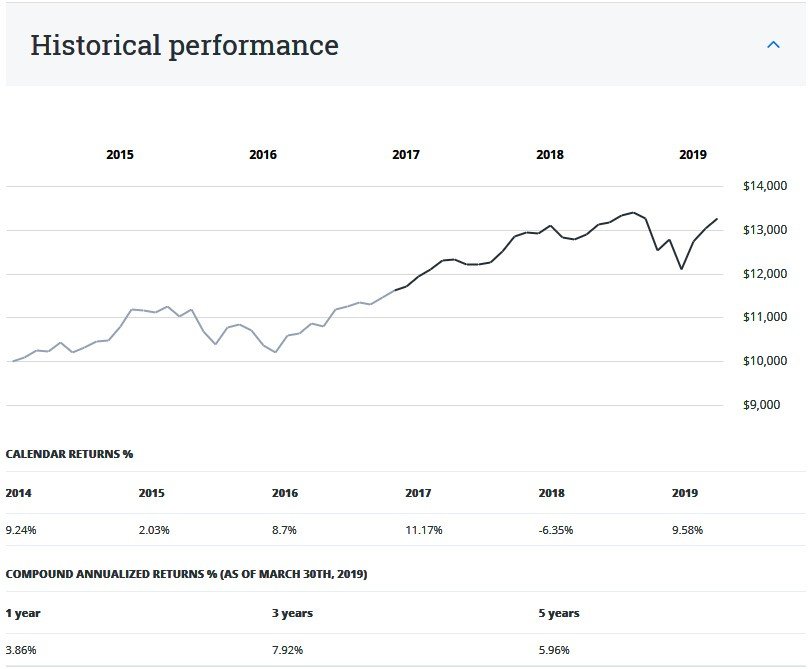

I was pleased with the way Questwealth Portfolios presented my portfolio results. They are adept at making it very easy for all potential clients—no matter their investing experience—to fully understand what kind of portfolio they are investing in. Using an example of a $20,000 initial investment, Questwealth Portfolios made clear exactly what ETFs I would be investing in, what percent each asset would make of my portfolio and how much I would be paying in management fees monthly. They also included a chart demonstrating the portfolio’s historic performance.

After you’re matched to your portfolio type, you then move on to choosing the kind of account you want to hold the portfolio in, such as a TFSA, cash account, or an RRSP. Then you go on to fill in more detailed info about your personal information and employment (generally standard questions for any financial institution when you open an account). You must also show proof of citizenship for tax reporting purposes.

Once your details are filled out you can then finish the setup process by transferring funds into the account from your bank.

Interface and usability

Questwealth Portfolios is big on helpful graphs and doesn’t overload you with fine print. Their streamlined website gives passive investors all the key information they need to know about their funds, without drowning them in complicated investing jargon. While I don’t find their platform as colorful and interactive as, say, Wealthsimple’s (Questwealth Portfolios tends to stick with a more serious looking gray and green color spectrum), it’s simple to use and relatively easy on the eyes. Bonus: The website also has informative webinars, as well as an engaging blog.

Customer service

Because Questrade and Questwealth Portfolios operate as an online-only brokerage, you can’t really go into their headquarters when you want to talk-face-to-face with an advisor (unlike a bank or traditional investment firm). Customer contact is limited to phone, social media, chat and email.

I’ve never called or emailed Questwealth Portfolios, but I have used chat and Twitter to reach out. I have always found the chat to be almost instantaneous and helpful, and I have never waited for more than half a day to get a response via Twitter.

Cost and fees

There are two main fee structures at Questwealth Portfolios: the management fee is 0.25% on accounts holding $0-$100K and 0.20% on accounts holding more than $100K. These fees are among the lowest in the country for robos and they cover everything from setting up your portfolio, to periodic account rebalancing and dividend reinvestment. The ETFs come with their own MERs that range from 0.17%-0.22%. The Questwealth SRI Portfolios have portfolio MERs ranging from 0.21%-0.35%. Questwealth Portfolios will rebate up to $150 of the transfer out fee for each account you transfer to them.

One downside: You do need a minimum balance of $1000 to open an ETF portfolio with Questwealth Portfolios (this can be a big deterrent for those looking to start off with just a few hundred dollars to see if passive investing suits them).

The verdict

If you’re looking for a low-cost, easy investment strategy that won’t demand much of your time or attention, Questwealth Portfolios is among the best (and cheapest) robo-advisors in Canada.

Use it if...

- Low fees make you happy

- You’re an investing beginner who wants to explore what ETFs and robo-advisors are about (and you aren’t turned off by the $1000 account minimum required)

- You don’t need a lot of hand holding or one-on-one time and are fine with customer service via email, chat or phone

- You love interactive, streamlined websites that don’t include a lot of financial minutia

- Socially responsible investing appeals to you

- The idea of self-managing your own portfolio and tackling investing on your own gives you night sweats

Don’t use it if...

- You like a lot of personalized, face-to-face time with a financial advisor

- You aren’t comfortable online and don’t even use your traditional bank’s website to do online banking

- Annual reports and stockholder meeting transcripts are your idea of great summer reading

- Selling stocks and rebalancing your own portfolio gives you an adrenaline rush

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

-1689964951.png)