RBC InvestEase review

Roman Samborskyi / Shutterstock

Updated: August 08, 2023

- Smart, automated investing

- Low fees

- Reliability and security of RBC, Canada’s largest bank based on market capitalization

- Canada's most comprehensive ETF offering

- Responsible Investing Portfolios

- Quick and easy access to advice through accredited Portfolio Managers

About RBC InvestEase

RBC InvestEase fits perfectly in between RBC’s full-service lineup of mutual funds, and its self-directed RBC Direct Investing platform for do-it-yourself investors. Backed by the clout and security of a big bank, RBC InvestEase is not only a great option for RBC clients to save on fees and grow their portfolios, but it also rivals the best robo-advisors in Canada. In fact, their annual fees match those charged by Canada’s leading robo-advisor, Wealthsimple.

As an investor, all you need to do is choose your account type and deposit money – as little as $100 to start investing – into your account. Next, RBC InvestEase recommends the appropriate investment plan that is personalized for you. Then accredited portfolio advisors invest your money in a portfolio of carefully selected ETFs on your behalf, and monitor and rebalance your funds to help you stay on track.

There are additional benefits if you are an existing RBC client. For example, InvestEase is fully integrated into the RBC Mobile app and RBC Online Banking so you can see all your accounts in one place – no need for another app on your phone. You also benefit from instant transfers from your bank account to your investment account.

RBC InvestEase features

Here are some of the features that make RBC InvestEase stand out to investors:

Best-In-Class Investments: RBC InvestEase portfolios are built with RBC iShares ETFs – Canada’s most comprehensive ETF offering. It has a combined total of 150 ETFs and approximately $60 billion in assets under management.

Reliability and Security of RBC: While most robo-advisors are start-ups that have launched within the past five years, RBC InvestEase is backed by RBC, the largest bank in Canada based on market capitalization that’s been in existence for more than 150 years.

Responsible Investing Portfolios: RBC Invest Ease’s Responsible Investing Portfolios are built with passive exchange-traded funds (ETFs) from RBC iShares, which combine traditional investment approaches with environmental, social, and governance (ESG) insights. The RBC iShares’ Responsible Investing ETFs are screened to exclude companies involved in tobacco, controversial weapons, and civilian firearms.

Automatic Re-Balancing: When your portfolio becomes unbalanced with too much of one asset class or too little of another, RBC InvestEase portfolio advisors will buy or sell the required (ETF) units to bring you back to your original target allocation. Rebalancing helps ensure that your portfolio stays in line with your objectives.

Professional (Human) Advice: RBC InvestEase clients can access a team of accredited Portfolio Advisors by calling 1-800-769-2531 during regular hours of operation from 8am to 8 pm ET.

Transfer fees: If you’re moving your investment accounts to RBC InvestEase, they will cover up to $200 in transfer fees when transferring $1000 or more.

RBC InvestEase fees

Clients of RBC InvestEase pay an annual management fee of 0.50% + applicable sales tax (billed monthly, based on your account’s average Assets Under Management). The management fee is the same for both a Standard Portfolio and a Responsible Investing Portfolio.

As with all robo-advisors, the next layer of fees is comprised of the weighted average management expense ratio (MER) of the ETFs held in your portfolio. The Standard Portfolio comes with ETF MERs ranging from 0.11% to 0.22%, depending on the asset allocation you have set-up. The Responsible Investing Portfolio accesses different ETFs that come with MERs ranging from 0.18% to 0.30%.

Altogether a client would pay fees of between 0.61% to 0.72% for the Standard Portfolio and between 0.68% and 0.80% for the Responsible Investing Portfolio.

* Fees: 0.50% management fee

* ETF MERs: Standard: 0.11% - 0.22% MER

Unlike other robo advisors, RBC InvestEase does not offer tiered pricing discounts based on higher assets under management. From our research, RBC has the simplest, most transparent, easiest-to-understand fee structure with a flat 0.5% fee based on your account’s average Assets Under Management.

Note that RBC sometimes has limited-time promotions waiving the 0.5% management fee for a period of time.

Pros and cons

Here’s a look at the pros and cons of opening an account and investing with RBC InvestEase.

Pros

-

Backed by the reliability and security of RBC

-

Access to the largest, most comprehensive suite of ETFs from Blackrock

-

Ultra-competitive fees for any size portfolio

-

Access to a team of accredited Portfolio Advisors

-

Covers transfer fees on all transfers above $1,000

Cons

-

No financial planning option for clients

-

No tiered price discount for larger accounts

-

Limited account selection and portfolio options

-

No mobile app

RBC InvestEase’s investing model

RBC InvestEase bills itself as a low-effort, automatic investing platform that anyone can use – no investing experience required. The ETFs recommended for your portfolio depend on your answers to a short online questionnaire. For example, someone investing for retirement with 30 years to save will get a different portfolio recommendation than someone investing for a house down payment and needs the money in five years.

Their portfolios are built using Blackrock iShares ETFs. When RBC InvestEase was initially launched it offered ETFs exclusively provided by RBC Global Asset Management. In early 2019, RBC and iShares entered into a strategic alliance with more than 150 ETFs and approximately $60 billion in assets under management.

RBC InvestEase uses ETFs because they offer diversification across asset types, sectors, industries, and geographies. They have lower fees than mutual funds, and they offer liquidity, meaning they are easily bought and sold on the market.

Your money is invested in a portfolio of low-cost ETFs and cash. To meet your goals, your investment portfolio will hold a diverse mix of asset classes. You can hold your investment portfolio in a TFSA, RRSP, or non-registered account.

Portfolio options

RBC InvestEase offers two portfolio options: the Standard Portfolio and the Responsible Investing Portfolio.

The Standard Portfolio

The Standard Portfolio is appropriate for those who want to achieve their investing goals and minimize fees. Here’s a run-down on what it includes:

- Globally diversified and built with low-cost, passive ETFs

- Low fees (management fee of just 0.5% per year on your investment balance, plus a weighted average MER of 0.11%-0.22%)

- Professionally rebalanced and managed by RBC InvestEase

The exact mix of assets will be determined by including your risk tolerance, investment experience, and time horizon. What we do know is your investment portfolio will include a mix of fixed income and equity ETFs and cash to meet your financial goals and tolerance for risk. The ETFs used in the Standard Portfolios include:

- iShares Core Canadian Short-Term Bond Index ETF

- iShares Core Canadian Universe Bond Index ETF

- iShares Global Government Bond Index ETF (CAD-Hedged)

- iShares Core S&P/TSX Capped Composite Index ETF

- iShares Core S&P 500 Index ETF

- iShares Core MSCI EAFE IMI Index ETF

- iShares Core MSCI Emerging Markets IMI Index ETF

The Responsible Investing Portfolio

The Responsible Investing Portfolio is meant for investors who want to achieve their future goals and make a positive impact on the world. It’s based on the following:

- Globally diversified and built with low-cost, passive ETFs with an in-depth environmental, social, and governance (ESG) integrated assessment

- Excludes companies involved in tobacco, controversial weapons, civilian firearms, and other companies involved in severe controversies

- Low fees (management fee of just 0.5% per year on your investment balance, plus a weighted average MER of 0.18%-0.30%)

- Professionally rebalanced and managed by RBC InvestEase

Here are the ETFs used in the Responsible Investing Portfolios:

- iShares ESG Canadian Short-Term Bond Index ETF

- iShares ESG Canadian Aggregate Bond Index ETF

- iShares Global Government Bond Index ETF (CAD-Hedged)

- iShares ESG MSCI Canada Index ETF

- iShares ESG MSCI USA Index ETF

- iShares ESG MSCI EAFE Index ETF

- iShares ESG MSCI Emerging Markets Index ETF

While two portfolio options might seem limited, know that RBC InvestEase tailors each portfolio based on the investor’s goals, time horizon, risk tolerance, and investing experience. The result is a portfolio that includes a mix of the above ETFs in different combinations and weightings depending on the client’s profile.

Portfolio Asset Mix

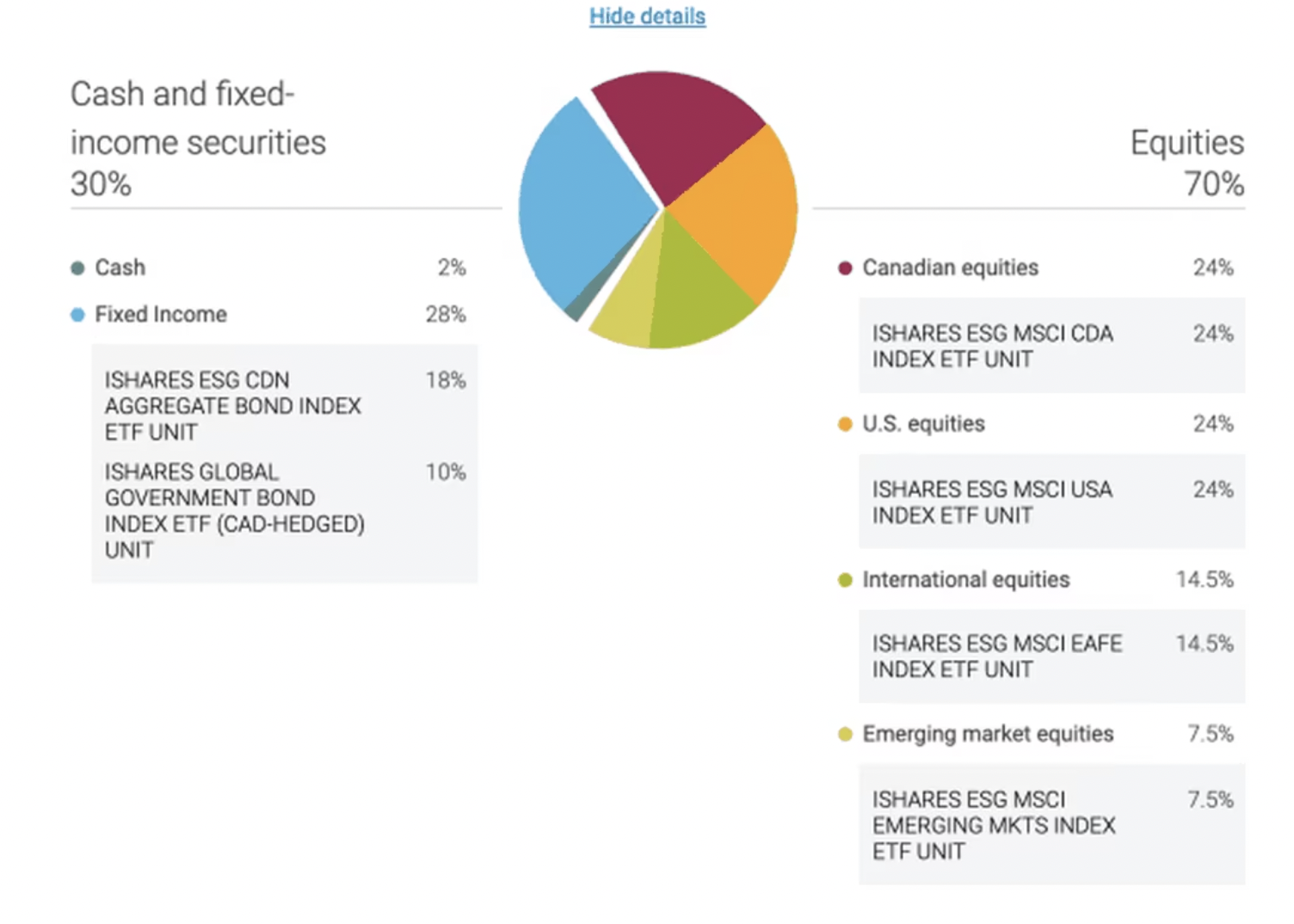

I went through the steps to open an account and fill out the initial questionnaire to see what type of portfolio would be recommended for me. Based on my age, investing experience, risk tolerance, and time horizon my recommended portfolio consisted of 70% equities, and 30% cash and fixed income securities (bonds).

The equities included 24% weighting to Canadian stocks, 24% to U.S. stocks, 14.5% to International stocks, and 7.5% to Emerging Markets. The fixed income component included 18% Canadian Bonds, 10% Global Government Bonds, and 2% Cash.

Here’s a screenshot breakdown of the asset mix:

How does RBC Invest Ease compare?

First, RBC InvestEase has the edge over BMO SmartFolio, the only other big bank in Canada with a robo-advisor platform. RBC InvestEase has lower fees, and thanks to its strategic partnership with iShares, now boasts a huge line-up of ETFs from which to build its portfolios.

But RBC InvestEase also compares favourably to our pick of best robo-advisors in Canada. In terms of fees, at 0.50% plus a very reasonable 0.11% – 0.22% MER, RBC InvestEase is right on par with Wealthsimple for investors with less than $100,000 to invest. The difference is that RBC InvestEase does not offer price breaks for investors with larger accounts – it’s a flat 0.50% management fee for every client.

Finally, the Responsible Investing portfolios offered by RBC InvestEase are constructed with passive exchange-traded funds (ETFs) from RBC iShares. The RBC iShares’ Responsible Investing ETFs are screened to exclude companies involved in tobacco, controversial weapons, and civilian firearms. Socially conscious critics may argue, however, that the Extended ESG Focus methodology used by RBC iShares is less rigid than it could be. The end result is that companies like Exxon Mobil will sneak through the fund’s screens. It’s obviously up to each investor to decide what is sustainable ‘enough’.

One major plus for RBC InvestEase is that they’re backed by RBC. It goes without saying that RBC is Canada’s largest bank-based on market capitalization and one of the largest companies in Canada. It has been around for more than 150 years and can offer the kind of security and reliability that is unmatched in the relatively infant field of robo-advisors, and has become increasingly important in consumers’ minds during uncertain times.

For a more in-depth comparison, check out our guide to the best robo-advisors in Canada.

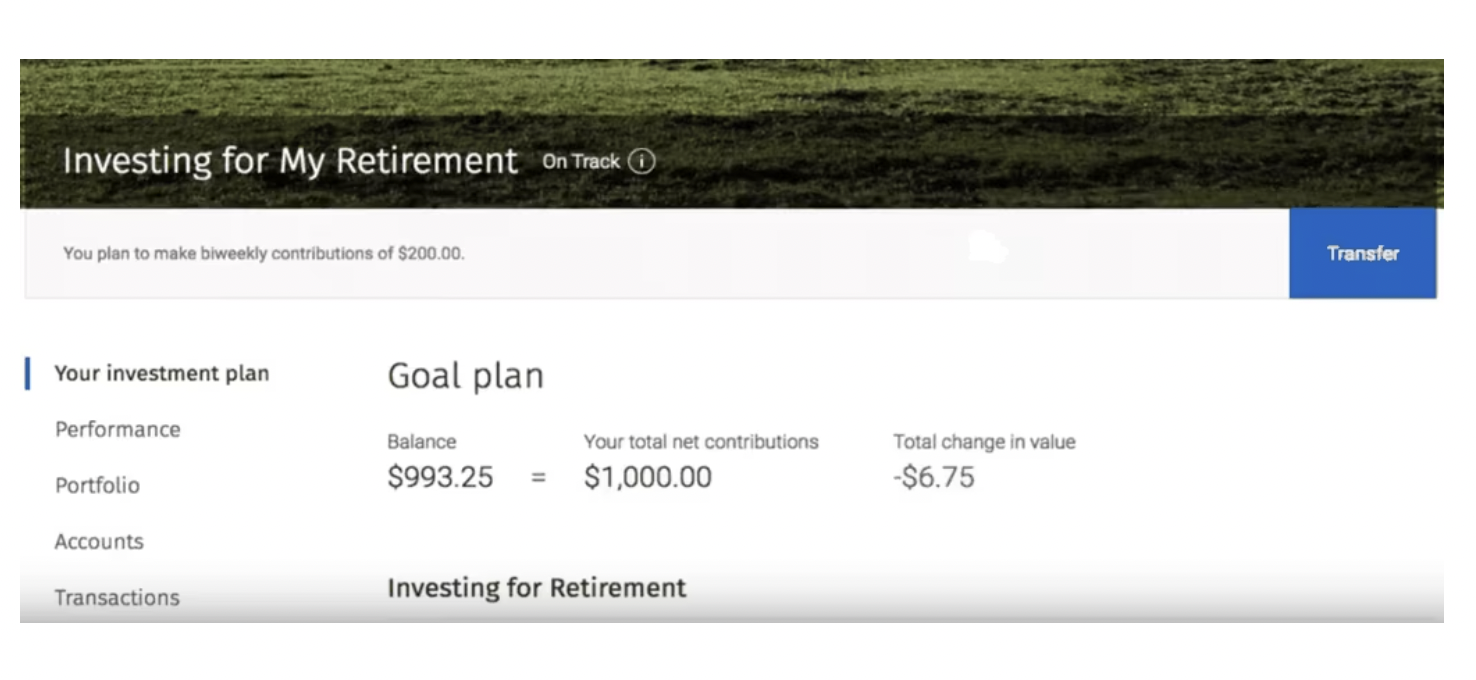

User experience: A peek inside RBC InvestEase

Existing RBC clients will have no trouble navigating the RBC InvestEase platform. It can be accessed and viewed from RBC Online Banking and is accessible through the RBC Mobile App.

The main dashboard is what you’d expect from a robo-advisor online platform. A seamless design that clearly shows your investment plan, performance, portfolio balance, and latest transactions in an easy-to-navigate front page.

While lacking the bells and whistles of an upstart robo-advisor platform like Wealthsimple, RBC InvestEase is an upgrade over a typical “big bank” website experience.

Sign-up process

Here are the criteria needed for you to open an RBC InvestEase account:

- You are a resident in Canada

- You’ve reached the age of majority in your province/territory of residence

- You have a Social Insurance Number that starts with a number from 1 to 7

- You are opening this account on your own behalf and are not a General Power of Attorney, Public Trust or third party

- You’re the only person with a financial interest in and exerting control over the assets in this account

The sign-up process for RBC InvestEase was incredibly fast and seamless. Fill out a short questionnaire starting with your age and investment goals (retirement, a major purchase, the future). Then select whether you’re a new investor, if you own some investments through a financial advisor, or if you’re a self-directed investor.

From there you answer a question about your investing knowledge and whether you’re a novice or have been investing for some time. Explain how often you fund your account and what your plans are for your investments.

Finally, choose a risk level you are comfortable with for your investments:

From there you’ll receive a personalized portfolio based on your answers to those questions. Then you choose whether you’d like a Standard Portfolio type or a Responsible Investing Portfolio.

The last step before opening an account is to either sign-in to RBC banking (if you’re an existing client) or sign in with a fresh account so you can easily transfer money from your current financial institution.

Is RBC InvestEase safe?

There’s no question that having the backing of RBC carries a lot of weight. RBC Direct Investing provides custodial services for the money you invest with RBC InvestEase. That means RBC Direct Investing Inc. is responsible for keeping your financial assets safe, maintaining your accounts, record keeping, trade settlement and reporting.

Through RBC Direct Investing Inc., your account is protected up to certain limits by the CIPF in the event of the insolvency of RBC Direct Investing Inc. Under the RBC InvestEase Online Security Guarantee, if an unauthorized transaction is made in your account through the RBC InvestEase online dashboard, you will be reimbursed 100% for any direct losses in your account. Terms and conditions will apply.

The bottom line

RBC InvestEase is definitely worth a look for new investors looking for a low-effort, low-fee, automated online solution to investing. Any client who is tired of paying high mutual fund fees should absolutely switch to the robo-advisor platform to save on fees. Furthermore, RBC InvestEase stacks up well against the best robo-advisors in Canada for investors with less than $100,000 to invest.

Socially conscious investors may find the Responsible Investing Portfolio lacking in rigour compared to other SRI options offered by Wealthsimple, ModernAdvisor, CI Direct Investing, and Questwealth. That said, the RBC iShares’ Sustainable Core ETFs are a decent option for those looking for a sustainable investing portfolio.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.