TD’s *NEW* Direct Investing platform – reviewed

rafapress / Shutterstock

Updated: August 17, 2020

I have to be honest in saying that I was slightly skeptical when recently presented with an opportunity to be guided through TD Direct Investing‘s new platform. It wasn’t that I didn’t think TD would be able to handle the fundamentals of DIY investing, such as buying and selling stocks and bonds within a TFSA or RRSP, I just know how fierce the competition has been when it comes to innovation in the financial technology sector the past few years. Small, nimble companies have been putting out user interfaces that have set a new standard for usability and aesthetic pleasure. Truthfully, I wasn’t sure how committed one of Canada’s major banks would be to revamping a brokerage that was serving quite a sizeable group of users just fine. Banks aren’t exactly known as “risk takers” after all.

Initial impressions and the home page

I am happy to say that I was immediately positively surprised!

TD’s new home screen is simple, elegant, and vivid. It looks like they hired someone from Apple to come down and improve the text-heavy look of their old dashboard.

At a glance, users can now take in:

- Their total overall balance.

- The individual balance of each account (RRSP, TFSA, margin, etc).

- A colour-coded visual of the investments held within each account.

- A section on the right-hand side titled “your events” operates as a Facebook-esque scroll of the news pertaining to the companies you’ve invested in or that are on your “watch list”.

The new menu has been pared down considerably from the all-options-listed model that TD used before. In their place, we now have a few simple and clean menu options. TD states that they wanted fewer levels of navigation, with more intuitive navigational combinations. What this means in layman’s terms is that it is much easier to get where you want to go and to see what you want to see right from the first time you come to the site. This is especially true if you are accessing the platform through a smartphone or tablet.

Related: See Robb Engen’s take on TD’s New Direct Investing platform

Features

For folks like me who are pretty vanilla couch potato investors, the easy-to-use home dashboard is almost all we’ll ever need. You can tell right away using the simple visuals what will need to be re-balanced and then make the necessary adjustments.

If you are set on becoming an active investor, then the TD platform really shines. The customizable news events feature allows you to quickly scan all the market updates that pertain to the companies that are currently part of your portfolio. For example, quarterly updates or major changes in management will go straight to your feed. There is all manner of bells and whistles if you wish to track companies’ performance, and more graphing options than most people will ever use.

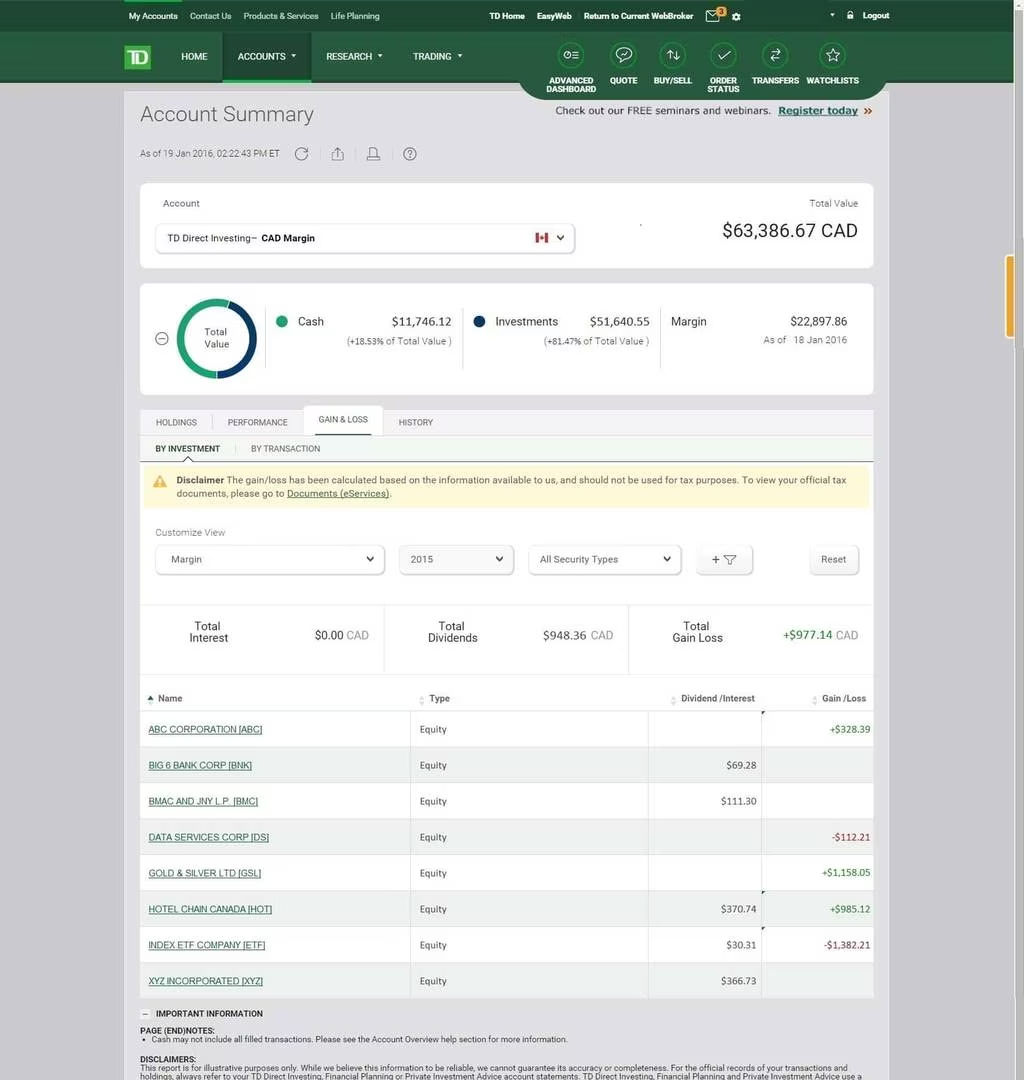

One really cool option that pertains to folks who wish to trade equities in a non-registered account (where tax planning is a major consideration) is the gains vs losses chart. By looking at which trades you’ve made and “locked in” either profits or losses, you can easily handle much of your tax preparation and tailor any tax-loss harvesting strategies you may wish to implement towards the end of the fiscal year. This chart is also easily exportable straight to Excel.

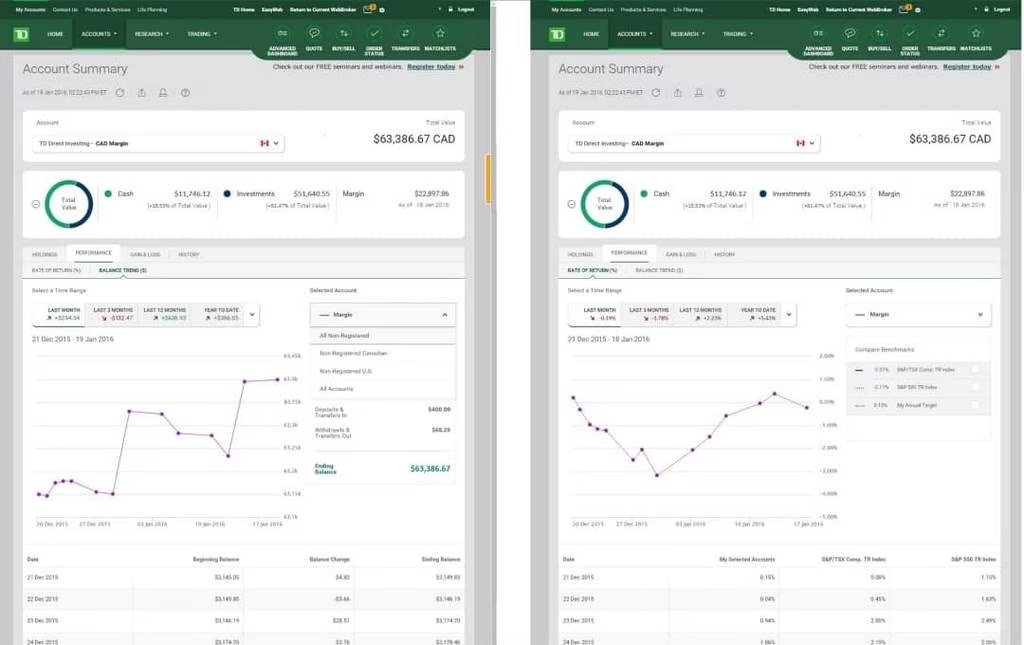

One of my favourite features (again, as a boring index investor) is all of the graphic and visual options that TD presents for tracking your investments over time. There are all the basic performance graphs that you would expect, but then you can add several different overlays if you wish to see how you are doing against several different indexes. You can even devise your own custom standard to compare against your current portfolio. Direct Investing also cleverly allows you to track both your portfolio’s “money-weighted rate of return” and your overall balance. The difference is that your overall balance will be affected by new deposits and withdrawals, whereas if you want to know how your investments have done independent of any new money being put in (or taken out), then it is easy to see that as well.

Commitment to education

The final area in which TD’s new platform really impressed me was the wide range of educational resources they’ve developed. Sure, there’s the usual stuff about how to do a limit trade and a market trade, and what a stock is versus a bond, but there is also so much more. For relatively seasoned investors who have a high degree of investing knowledge but perhaps could use a hand with how to navigate the platform, there are some quick and easy videos to guide you on your way. If you’re a beginner investor who is quite comfortable with the technological side of things but wishes to learn about what certain graphs mean, or how to best use some of the research filters, they’ve got you covered there as well.

There are over 80 videos and webinars that makeup over eight hours of educational resources waiting to be accessed. You can learn at your own pace, and while the total amount available might be a bit intimidating at first, TD has chunked up the information into bite-sized pieces that you can sample at your leisure. The administrative staff has also assured me that they were making education and financial literacy a real point of emphasis going forward, and consequently they would continuously be adding new content. I commend TD for making this investment of time and money as more and more people begin to dip their foot in the DIY investing pool.

Related: Questrade Discount Brokerage review

Concluding thoughts

Overall, I think TD has done a fantastic job of revamping its new platform. The user experience is easily customizable so that a simple needs investor like me doesn’t feel overwhelmed, yet a person who actively trades and has much higher needs than me can also get everything they want. The site looks great on a small screen – which is much harder to create than you might think – and is as user-friendly as it is aesthetically pleasing.

Please note this post has been brought to you in partnership with TD, all thoughts and opinions are my own.

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.