The history of Bitcoin cryptocurrency

The mysterious Satoshi Nakamoto may have been one person (or a number of people) who designed the original Bitcoin protocol in 2008. The world’s first Bitcoin transaction took place on January 12, 2009, when “founder” Nakamoto sent 10 Bitcoins to a programmer named Hal Finney. Interestingly, Nakamoto is thought to potentially have mined 1 million Bitcoins before disappearing.

By late 2013/early 2014, merchants like Overstock.com, TigerDirect, and Zynga began accepting Bitcoin as payment. Microsoft even started to accept Bitcoin as payment for Xbox games. Bitcoin even gained legitimacy and wider adoption as a legal payment method in countries like Japan and Russia. Nearly 5,500 Bitcoin ATMs were available worldwide, mostly in the United States, Canada, and the UK.

In 2017, Bitcoin split into two digital currencies: Bitcoin (BTC), and Bitcoin Cash (BCH). Bitcoin euphoria reached its peak at the end of 2017 with the price of one coin reaching nearly $20,000.

But public sentiment soured soon after. Bitcoin started to get phased out as a currency for goods and services, citing low demand and price volatility. Some countries even banned the anonymous trading of Bitcoins.

While Bitcoin didn’t gain much traction as a currency, the next few years will see more regulation and wider adoption of Bitcoin as an investment.

How Bitcoin cryptocurrency works

Bitcoins are “mined” by individuals who use computers to solve complex cryptographic puzzles to discover new “blocks,” which then get added to the blockchain. Successful miners receive a “block reward,” giving them a predetermined number of Bitcoin. That number is “halved” every 210,000 blocks. In 2009, miners received 50 new Bitcoins. Today, the reward for a new block will yield 6.25 Bitcoins.

This “halving” is due to the finite supply of 21 million Bitcoins. There have been around 18 million successfully mined Bitcoins, leaving another 3 million yet to be discovered.

Once in possession of a Bitcoin, users can store it in a digital wallet on a mobile device or computer. These are known as “hot” wallets. Or Bitcoins can be stored more securely in a “cold” wallet offline. This would be on a computer that is not connected to the internet.

Bitcoins can be traded on a cryptocurrency exchange for other alt-coins (i.e. Ethereum, Litecoin, Ripple), or for a government-backed currency like Canadian or U.S. dollars.

Bitcoins can also be used as a medium of exchange at retailers that accept digital currency for goods and services. The most famous Bitcoin transaction occurred on May 22, 2010, when a Florida man named Laszlo Hanyecz paid 10,000 Bitcoins for two Papa John’s pizzas. Those 10,000 Bitcoins would be worth $150,000,000 today (although they were worth just $41 at the time).

Cryptocurrency Bitcoin price: How does Bitcoin compare to other cryptocurrencies?

While Bitcoin is the most popular cryptocurrency, there are more than 6,000 digital currencies on the market with a total market cap of $337 billion (August 2020).

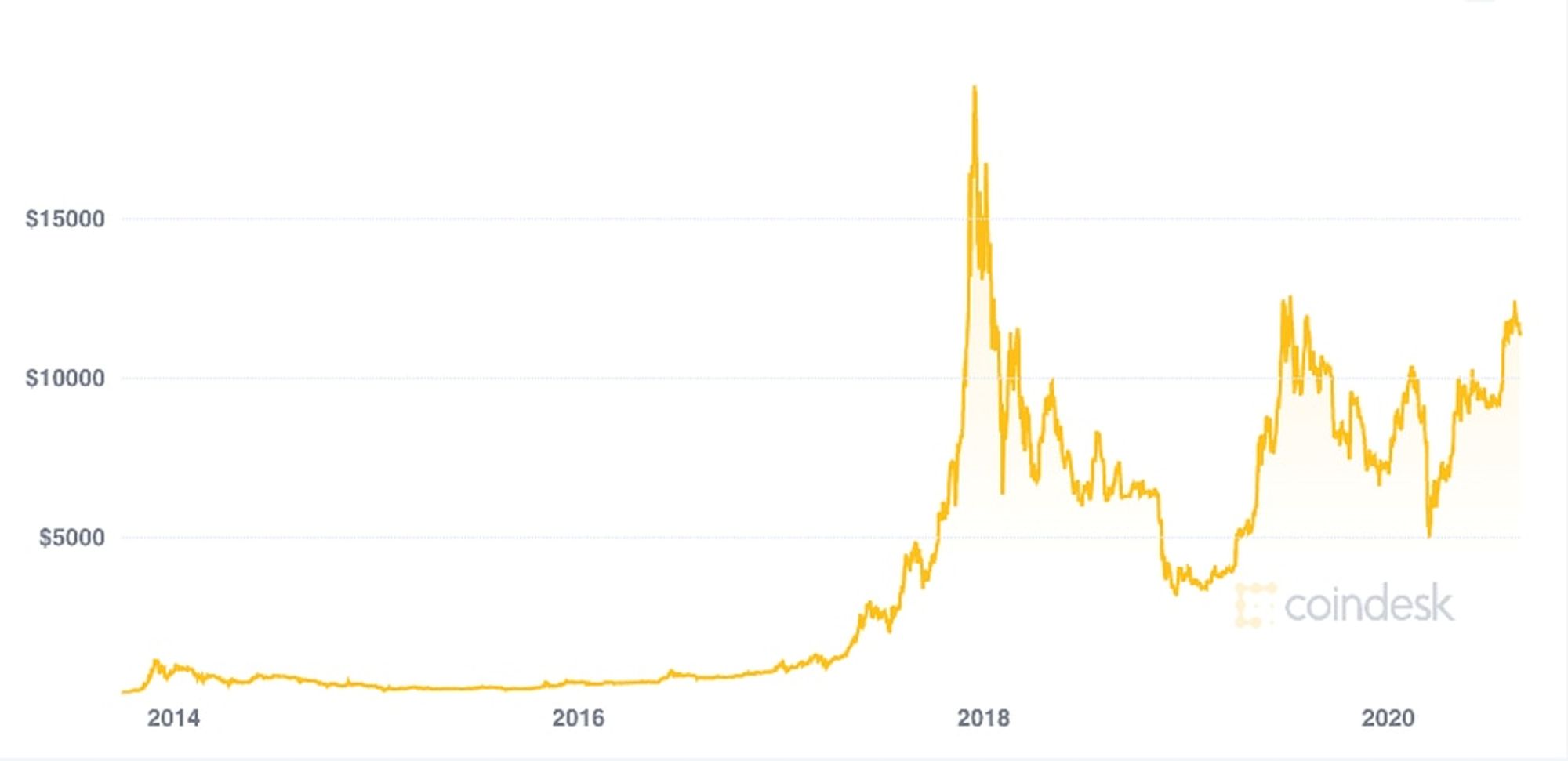

Bitcoin’s price history has been extremely volatile. It began trading on March 17, 2010, on the now-defunct exchange BitcoinMarket.com. In 2013, its price increased from $150 to $1,242 in just two months. The price fell back below $1,000 where it stayed relatively steady until January 2017. That’s when the price skyrocketed, taking the price of one Bitcoin from $750 to nearly $20,000 by the end of the year.

It wasn’t all positive for Bitcoin investors. The price crashed hard from its peak on December 17, 2017, and five days later one coin was worth just $13,800 – a 33% drop in less than a week. It continued its freefall; by February 2018 Bitcoin had lost another 50% of its value, and by December 2018 Bitcoin fell another 50% to $3,300.

Today, Bitcoin trades at just under $15,000 CAD (August 28, 2020). It has given investors plenty of stomach-churning moments in the last three years, but remember that Bitcoin is still relatively new as an investment. We’re still learning how it behaves in relation to the market and economic events, and how much, if at all, it is correlated with stock markets around the world.

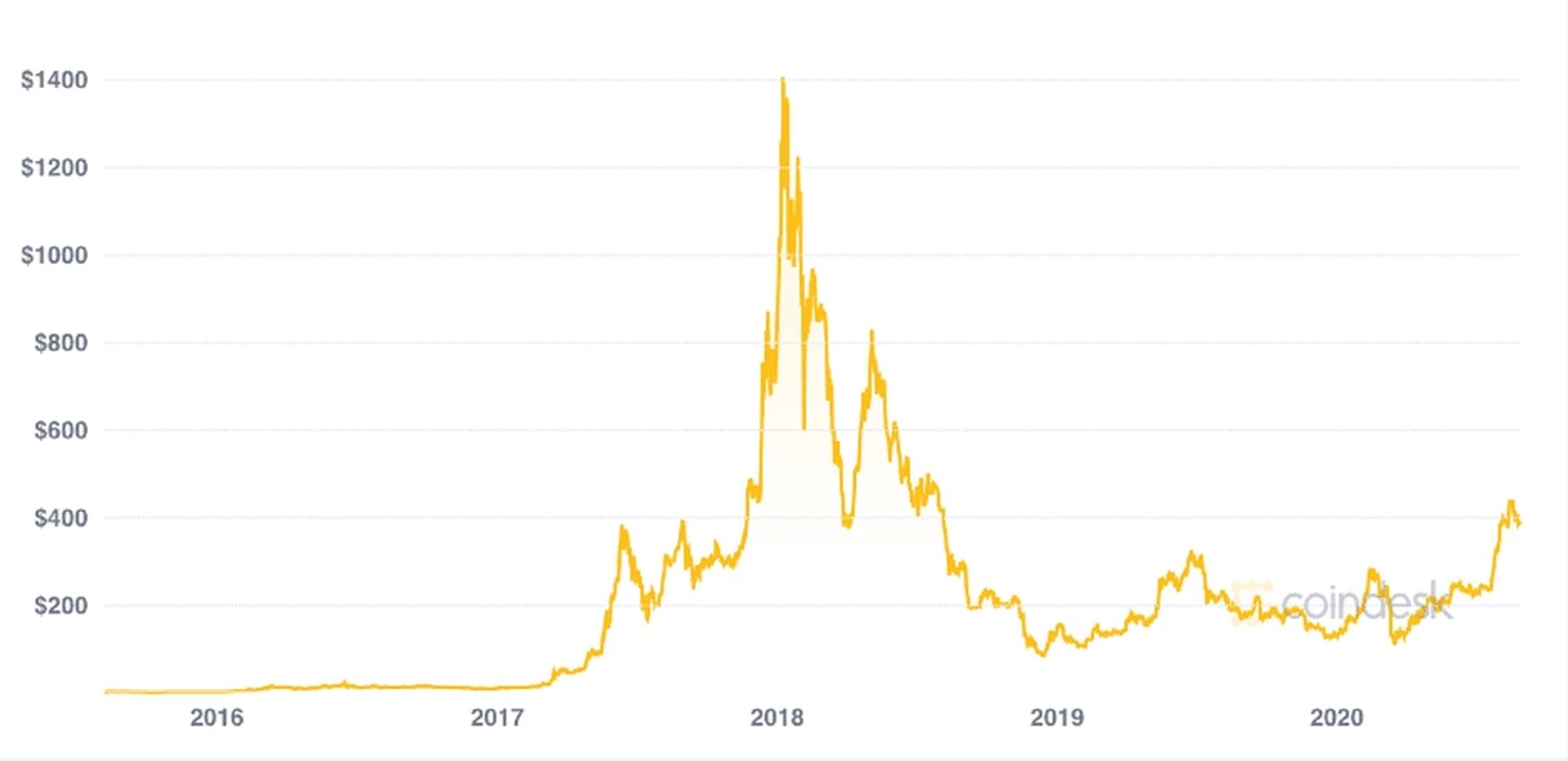

Other alt-coins or cryptocurrencies like Ethereum have also experienced incredible volatility, which can likely be attributed to a cryptocurrency fuelled mania in 2017. Again, the story is still being written about cryptocurrencies and whether they will be accepted as a digital currency, store or value (like precious metals), or simply as an investment for speculators.

| Cryptocurrency prices (in CAD$) as of August 28, 2020 |

|---|

| Bitcoin (BTC): $15,093 |

| Ethereum (ETH): $519 |

| Tether (T): $1.31 |

| XRP (XRP): $0.35 |

| Bitcoin Cash (BCH): $352 |

| Litecoin (LTC): $74 |

Despite the high price of one Bitcoin today, traders should know that they can purchase fractions of one coin. In fact, with the Wealthsimple Crypto trading app, users can buy as little as $1 worth of Bitcoin. This is an important takeaway, as very few traders would be able to afford to buy and sell one full Bitcoin at its current price.

Trends in Bitcoin value

We’ve talked about the volatile price movements of Bitcoin, but what does its history tell us about the future trends in Bitcoin value? Bitcoin has seen a total return of 8,803% since 2013. That’s an incredible 184.5% annualized return, making Bitcoin one of the best investments of the past seven years.

Cryptocurrency experts predict Bitcoin could hit $20,000 by the end of 2020, and an eye-popping $341,000 by the end of 2025. The reason for that bold prediction is that Bitcoin is still in the early stages of adoption. If Bitcoin ever reached the popularity of, say, gold, then its price is extremely undervalued today.

There’s also the fact that Bitcoin has a finite supply of $21 million coins, making it somewhat of a scarce resource (although these coins aren’t expected to be mined until the year 2140). In this respect, you could view Bitcoin as a form of digital gold.

Finally, the advent of new and more trusted trading platforms, such as Wealthsimple Crypto, is meant to bring more awareness to cryptocurrency trading. There are hundreds of thousands of cryptocurrency traders in Canada looking for safe ways to trade Bitcoin and other alt-coins. Perhaps as the cryptocurrency space becomes more tightly regulated, we will see wider adoption of cryptocurrencies like Bitcoin getting added to investor portfolios, much like gold and other precious metals have been for decades. This could speed up the adoption curve and increase the value of Bitcoin and other cryptocurrencies as more traders emerge.

How secure is Bitcoin and the cryptocurrency industry?

Bitcoin and cryptocurrency in theory are as secure as it gets – with a record of every transaction ever made stored in the public blockchain and on every computer that participates in the network.

But more than $1.7 billion in cryptocurrency has been stolen over the years, as coin exchanges have proven to be prime targets for hackers and thieves. One hack involved the popular exchange Binance, which saw 7,000 Bitcoins stolen in a single transaction. Binance made its customers whole by using its emergency insurance fund, but other victims of cryptocurrency hacks haven’t been so lucky.

As if hackers weren’t enough to worry about, consider the case of QuadrigaCX, believed to be Canada’s largest cryptocurrency exchange. Company founder Gerald Cotton reportedly died after travelling to India in 2018. He held the password to the company’s offline cold wallets, where 115,000 customers held up to $250 million in cryptocurrency. Stranger still, after investigation, officials found these wallets were empty and Gerald was running a Ponzi scheme.

All of this to say, the first principle of Bitcoin is: Trust No One, and the second is: Have a Plan B.

If you forget your car keys you can call a locksmith, and if you forget your banking password, you can get a new one. If you lose the private key to your cryptocurrency wallet, your funds are gone forever.

The bottom line

The Bitcoin story is still being written but it’s clear the digital currency is here to stay as a medium of exchange, store of value, and as an investment.

Will we ever use Bitcoin to buy pizza again? Not likely. Will investors continue to see 184.5% annualized returns? That’s doubtful. But it wouldn’t be surprising to see portfolio managers and individual investors allocating 5-10% of their portfolios to cryptocurrencies like Bitcoin.

Ready to add Bitcoin to your portfolio? The easiest way to do this is through the Wealthsimple Crypto platform. Download the Wealthsimple Trade app today and you can start trading Bitcoin and Ethereum with as little as $1. If you’re a first-timer, learn how to start Bitcoin trading.

New to investing? There’s more to investing than just cryptocurrency. Get the basics with how to start investing in Canada.